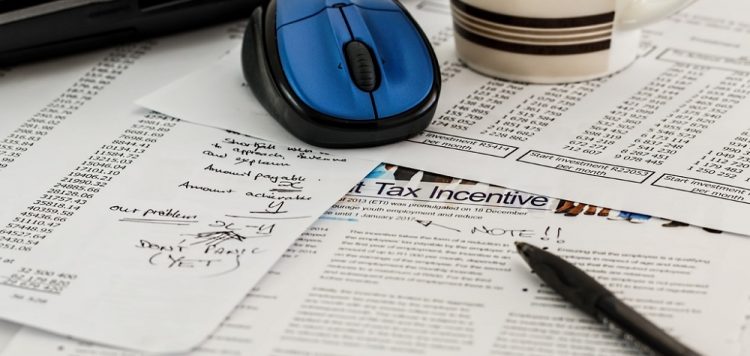

Earlier this year, the IRS agreed to provide special tax filing relief to individuals as a result of the Covid-19 outbreak. Filing and payment deadlines for 2019 tax returns were extended from April 15 to July 15, 2020. Although a taxpayer was given the option of extending the July 15th filing deadline, the same is not true for the payment deadline and the entirety of the taxpayer’s 2019 tax liability is payable on July 15th even if they seek an extension to file their tax return. Moreover, as a result of the current economic situation, many taxpayers may file their returns but find themselves unable to pay the tax that is due. Penalties and interest will begin to accrue on any remaining unpaid balances as of July 16, 2020 and a taxpayer will become subject to the IRS collection procedures that ultimately can include actions such as the seizure of property and the filing of tax lien.