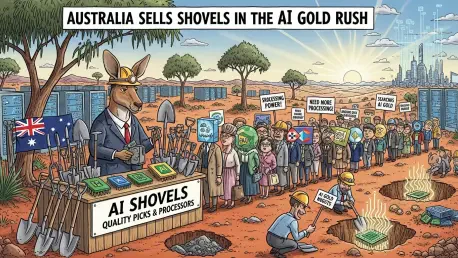

The global technology landscape is currently witnessing a period of frenzied investment and soaring valuations centered on Artificial Intelligence, a phenomenon widely described as a modern-day gold rush. In this high-stakes environment, where capital, strategic focus, and regulatory attention are converging, the Australian market has carved out a distinct and pragmatic role for itself. While prospectors worldwide are digging for digital gold by developing groundbreaking AI applications, a quieter but equally significant boom is occurring in the foundational infrastructure that powers the entire enterprise. This analysis reveals a clear trend: a dramatic surge in AI-related venture funding, a strategic and highly profitable pivot toward investing in the industry’s essential tools, and an evolving, uniquely Australian regulatory framework that is shaping the future of this technological revolution from the ground up. The consensus points to a genuine step-change in capital allocation, where the most durable value may lie not in the search for gold itself, but in selling the picks and shovels.

A Decisive Shift in Venture Capital Funding

Over the last 18 months, the venture capital sector has undergone a seismic shift, with AI rapidly moving from a conceptual sideline to the undisputed main event, commanding the lion’s share of investment dollars and attention. This is not a cyclical trend but a fundamental realignment of funding priorities that is reshaping competitive dynamics for high-quality deals across the globe. According to 2025 data from Crunchbase, AI-focused companies in the United States are attracting an unprecedented volume of VC funding, a pattern that is being closely mirrored Down Under. Reporting from Cut Through Ventures has consistently ranked ‘AI and Big Data’ as one of Australia’s most active investment categories, measured by both the sheer number of deals and the total capital deployed. This surge reflects a broad consensus among investors that AI represents a foundational technology shift, prompting a rapid reallocation of resources toward companies poised to lead in this new era and creating an increasingly competitive environment for securing stakes in promising ventures.

This wave of investor enthusiasm has translated directly into a flurry of tangible market activity, fueling increasingly competitive funding rounds and pushing company valuations to new heights across all stages of the corporate lifecycle. The growing dominance of AI is powerfully illustrated by LinkedIn’s 2025 list of ‘Top 20 Australian Startups,’ which featured seven AI companies—a significant jump from just two in the previous year. For the first time, AI has broken into the top five most funded sectors in Australia, ranking second by deal count in the second quarter of 2025. This momentum is evident from the earliest stages, with pre-seed investments like Rampersand’s backing of Keeyu and Blackbird’s support for Enhance Labs demonstrating a strong appetite for emerging platforms even before they generate revenue. At the later stages, the scale of investment is monumental, with established players like Harrison.ai and Heidi each securing funding rounds well over $100 million in the past year alone, underscoring the deep capital commitment to scaling proven AI technologies.

The Infrastructure Play of Picks and Shovels

A key strategic insight emerging from the AI investment boom is the immense value in focusing on the sector’s foundational infrastructure, a strategy likened to selling picks and shovels during a gold rush. This approach posits that the suppliers of essential equipment and services often secure more consistent and substantial profits than the prospectors searching for elusive fortunes. A prime example of this trend in the Australian market is Firmus Technologies, an infrastructure company that recently achieved unicorn status following a $330 million capital raising in September 2025, which valued the company at approximately $1.9 billion. The strategic nature of this play was underscored by the participation of NVIDIA, a global leader in AI computing, signaling the critical importance of Firmus’s mission. The capital is earmarked for “Project Southgate,” an ambitious initiative to construct four specialized AI data centers, or “AI factories,” across Australia, providing the raw computational power necessary to train and operate sophisticated AI models.

Firmus Technologies’ core value proposition lies in its proprietary liquid-based cooling system, a critical innovation designed to address one of the most significant operational challenges facing the AI industry: immense energy and water consumption. This technology reportedly reduces the energy use of its data centers by around 30% and slashes water usage by up to 99% compared to conventional air-cooling systems. The real-world importance of this efficiency is staggering; for every 20 to 50 questions posed to a large language model like ChatGPT, an estimated 500ml bottle of water is consumed for server cooling. With billions of such queries occurring daily, the environmental and operational costs are enormous, making Firmus’s technology a critical enabler for sustainable AI growth. The market’s profound confidence in this infrastructure-focused strategy was further demonstrated when Firmus secured commitments for an additional $500 million in November 2025, at a valuation more than double its September round, to accelerate its expansion plans.

Navigating Australia’s Unique Regulatory Terrain

While investment continues to surge, the long-term viability and direction of the AI sector in Australia will ultimately be shaped by its regulatory framework. The nation has been relatively slow to adopt a clear and comprehensive approach to AI regulation, creating a degree of uncertainty for businesses and investors. However, through ongoing economic reform roundtables, the government is actively working to address this gap, and the emerging consensus points toward a “less prescriptive regulatory model.” This approach would stand in contrast to the detailed and stringent AI Act implemented by the European Union, relying instead on a combination of sector-specific regulations and principles-based guidance. The primary focus is expected to be on clarifying rules for “high-risk” applications of AI, establishing clear lines of accountability for AI-influenced decisions, and setting transparent rules for data privacy and cross-border data flows, aiming to manage risks without stifling innovation.

This flexible regulatory philosophy is being complemented by pragmatic government support for the development of critical infrastructure needed to power the AI boom. The Government of New South Wales, for instance, has been actively working to accelerate the approval processes for large-scale data centers, recognizing their essential role in supporting the industry’s growth. The overarching goal is to cultivate a stable and investable environment that encourages technological advancement while ensuring that Australian companies can access global AI technologies. Despite this supportive posture, a significant legal hurdle remains in the form of Australia’s strict copyright laws. Unlike jurisdictions with broader “fair use” exemptions, such as the United States, Australian law provides very limited exceptions for the unauthorized copying of material. This poses a major challenge for companies developing AI models, which require vast datasets for training. Although an exemption for AI training was proposed, the government has indicated it has no current plans to introduce it, forcing AI companies in Australia to be meticulous in securing permissions and licenses for their training data—a complexity that could place them at a competitive disadvantage.

A Calculated Bet on Foundational Strength

The frenetic pace of investment confirmed that the AI gold rush was not a fleeting moment but a fundamental reshaping of the technological and economic landscape. In this environment, Australia’s strategic decision to focus on the “picks and shovels” of the industry proved to be a remarkably astute one. Rather than competing directly in the high-cost, high-risk race to develop foundational large language models, the nation’s innovators and investors channeled their resources into building the critical infrastructure—the specialized data centers and energy-efficient cooling systems—that the entire global ecosystem depended upon. This approach not only mitigated risk but also established a crucial and enduring role for the country in the AI supply chain. The regulatory path, though slow to form, ultimately reflected this pragmatism, seeking to foster a stable investment climate while grappling with complex legal challenges like copyright. This strategic positioning solidified Australia’s identity not as a prospector for digital gold, but as the indispensable supplier of the tools every prospector needed to succeed.