The traditional battlegrounds of wealth management, once fought over exclusive products and competitive pricing, are rapidly being redrawn by the seismic force of enterprise technology. A new strategic imperative has emerged where industry leaders are no longer just acquiring tools but are architecting fully integrated, full-stack ecosystems designed to defend market share and redefine the client-advisor relationship. This profound shift signals a move toward the “industrialization” of sophisticated planning processes, where complex services like portfolio management and estate planning are scaled efficiently without sacrificing the advisor’s central role. In this escalating technological arms race, the ability to hardwire advanced capabilities directly into a firm’s core platform is becoming the definitive measure of competitive advantage, a trend vividly illustrated by recent, large-scale initiatives from industry titans such as Edelman Financial Engines and LPL Financial, who are betting their futures on building superior technological infrastructures.

The Titans of Tech: How Industry Leaders Are Rebuilding Their Platforms

Edelman Financial Engines: Forging a Unified Operating System

The strategic collaboration between Edelman Financial Engines and Orion Advisor Solutions represents a decisive move to construct a singular, connected ecosystem for its entire advisory force, effectively creating a unified technological backbone. This initiative is engineered to consolidate previously fragmented functions, including portfolio management, trading, comprehensive data analytics, and client engagement, onto a single, cohesive platform. The fundamental objective is to eradicate operational inefficiencies and dismantle the silos that often hinder internal collaboration. By creating this seamless operating environment, the firm aims to liberate its financial planners from the administrative burden of navigating disparate systems, thereby empowering them to dedicate more of their valuable time to direct client interaction, strategic financial guidance, and the cultivation of deeper, more meaningful relationships with the households they serve.

At its core, the Orion-powered platform serves as a comprehensive operating system designed to enforce consistency and drive efficiency across the entire business. It equips Edelman’s planners with an arsenal of advanced tools that are directly integrated into their daily workflows, eliminating the disruptive “swivel-chair” effect of switching between multiple applications. Among its key capabilities are sophisticated portfolio management and trading functions that deftly simplify complex tasks like portfolio rebalancing and trade execution. Crucially, this system maintains the flexibility to accommodate household-level customizations and intricate tax-specific considerations, ensuring that scaled efficiency does not come at the expense of personalized advice. This unified approach is designed to transform the advisor’s desktop from a collection of disjointed tools into a powerful, integrated command center for holistic wealth management.

Key Capabilities of The Integrated Platform

The integration facilitates a continuous, real-time flow of data across all systems housed within Edelman’s chosen cloud environment, a capability that provides the firm with timely and highly actionable insights. This dynamic data sharing empowers more informed and strategic decision-making at both the enterprise and individual advisor levels, allowing for a proactive rather than reactive approach to market changes and client needs. Furthermore, the centralization of all client data and communications within a single platform dramatically enhances the potential for superior client engagement. When combined with Orion’s robust and intuitive reporting suite, this unified data source delivers clearer, more immediate insights. This empowers advisors to offer a higher caliber of proactive, deeply personalized service, anticipating client needs and communicating complex financial information with newfound clarity and impact, thereby strengthening the foundation of trust.

This newly consolidated technological framework is fundamentally reshaping the advisor’s day-to-day experience and, by extension, the value delivered to the end client. Planners can now operate from a shared, reliable data foundation, enabling them to make more integrated investment and financial planning decisions without the friction of reconciling information from multiple sources. This cohesive environment not only streamlines internal workflows but also ensures that every client interaction is informed by a complete and up-to-the-minute understanding of their financial picture. For the firm, this translates into greater operational leverage and the ability to scale high-touch advisory services more effectively. For the client, it means receiving more consistent, strategic, and holistic advice, solidifying the firm’s position as an indispensable partner in their financial journey and raising the bar for what constitutes a premium wealth management experience.

The New Differentiator: Industrializing Sophisticated Advice

LPL Financial: Revolutionizing Estate Planning with AI

In a parallel yet distinct strategic maneuver, LPL Financial has embarked on an enterprise-wide deployment of Wealth.com’s sophisticated digital estate planning platform, making it accessible across its vast network of more than 32,000 advisors. This initiative is a direct and calculated response to the escalating demand from high-net-worth clients for truly holistic financial advice that extends beyond mere investment management. As articulated by LPL’s leadership, estate planning is no longer a peripheral service but a critical and non-negotiable component of a comprehensive wealth strategy. This partnership is designed to arm LPL advisors and specialized planners with the advanced tools necessary to analyze, illustrate, and implement complex client estate plans with significantly greater speed, accuracy, and confidence, seamlessly integrating this vital service into their core advisory offering and value proposition.

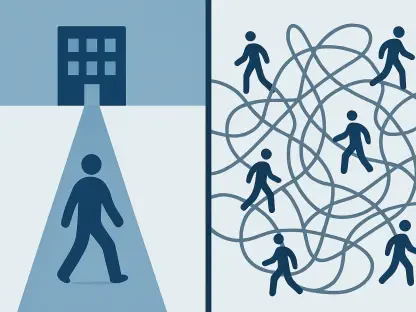

The collaboration represents a significant step toward the “industrialization” of what has traditionally been a complex, time-consuming, and often fragmented process. By providing a standardized yet powerful platform, LPL is enabling its advisors to address a core client need at scale, transforming estate planning from a specialized, ad-hoc engagement into a systematic and integral part of every client relationship. This move not only enhances the firm’s competitive positioning by offering a more complete service suite but also deepens the advisor-client relationship by addressing deeply personal and impactful financial matters. It equips advisors to lead more meaningful conversations about legacy, asset protection, and intergenerational wealth transfer, solidifying their role as the central, trusted figure in a client’s entire financial life and moving beyond transactional investment advice.

AI-Powered Tools and Next-Generation Features

A central and transformative component of LPL’s new estate planning capability is “Ester,” a proprietary AI-powered legal assistant specifically trained to decipher complex estate planning documents. This advanced technology can read and interpret dense legal texts, such as wills and trusts, automatically extracting key provisions, identifying fiduciaries, and mapping out asset distribution flows. It then presents this intricate information in a clear, visual, and easily digestible format for both advisors and their clients. This innovation is poised to save countless hours of laborious manual document review, drastically improve accuracy by minimizing human error, and, most importantly, shift the advisor’s focus away from administrative paperwork and toward providing high-value strategic guidance and counsel, turning complex legal jargon into actionable financial insight.

Beyond AI-driven document analysis, the platform introduces a new paradigm for how estate plans are managed and perceived. It positions the estate plan not as a static set of documents filed away and forgotten, but as a dynamic, living component of a client’s overall wealth strategy. Advisors gain access to dynamic estate reports that can be updated in real time, reflecting changes in assets, family structure, or regulations. The solution also features a permission-based digital vault, which centralizes all essential documents and makes them securely accessible to clients, their families, and other trusted professionals across generations. Furthermore, LPL’s Advanced Planning Team will leverage Wealth.com’s Family Office Suite, which includes a direct integration allowing planners to collaborate seamlessly on the most sophisticated cases within a secure, shared ecosystem, ensuring that even the most complex client situations receive expert, coordinated attention.

Redefining The Competitive Landscape

The large-scale technological undertakings by Edelman Financial Engines and LPL Financial represented a definitive and powerful signal for the entire wealth management industry. These moves made it clear that enterprise-grade technology platforms had transitioned from being back-office support tools to becoming the central pillar upon which a sustainable competitive advantage was built. For financial advisors operating within these modernized and integrated ecosystems, the immediate promise was a more cohesive, efficient, and less fragmented professional environment. They benefited directly from a significant reduction in the need to “swivel-chair” between disparate, non-communicating systems, which granted them faster access to critical planning insights and empowered them to make integrated investment and estate planning decisions from a single, reliable data foundation, ultimately enhancing the quality of advice they delivered. This shift fundamentally altered the advisor’s capacity to serve clients effectively.

For competing firms, these bold initiatives significantly raised the competitive stakes and reshaped the industry landscape. The ability to offer a differentiated and superior client experience would increasingly depend not just on the quality of their human advisors, but on the strength and sophistication of their enterprise technology partnerships. It became evident that success hinged on a firm’s effectiveness in translating that powerful technology into better, more comprehensive, and highly scalable financial advice. The arms race had firmly shifted its focus toward the creation of holistic ecosystems where technology did not replace the advisor but empowered them to deliver deeper, more tangible value to an increasingly sophisticated and demanding clientele. The message was clear: firms that failed to invest in and properly leverage these advanced platforms risked being left behind in a new era defined by technological prowess.