Malta International Airport has demonstrated an extraordinary period of growth, culminating in a landmark year that saw passenger traffic surpass all previous records and set a new benchmark for operational success. The airport’s strategic initiatives, which focus on expanding its network, mitigating seasonal lulls in travel, and undertaking significant infrastructure investments, have painted a clear picture of a company on a powerful upward trajectory. This robust performance, coupled with an optimistic forecast for the current year, underscores a period of sustained expansion. An analysis of its performance reveals a carefully managed growth strategy that has not only recovered from past global disruptions but has also propelled the airport into a new phase of development, even as its market valuation has yet to fully capture this fundamental strength. The narrative is one of strategic foresight and effective execution, positioning the airport as a key driver of Malta’s connectivity and economic vitality for the foreseeable future.

A Year of Unprecedented Growth

The 2025 calendar year was a historic period for Malta International Airport, officially cementing its status as a leading regional hub by handling a total of 10.06 million passenger movements. This significant milestone represented a substantial 12.3% increase over the previous record set in 2024, a testament to the surging demand for travel to the Maltese islands. This growth was underpinned by a deliberate and strategic increase in airline capacity, with available seats rising by just over 13% compared to the prior year. Despite this considerable expansion, the airport maintained remarkable operational efficiency, achieving a seat load factor of 85.4%. While this figure marks a slight decrease, it remains an exceptionally healthy indicator, signifying that the vast majority of available seats were filled and that the growth was both managed and sustainable, reflecting a perfect synergy between supply and high consumer demand. This performance highlights the airport’s ability to effectively scale its operations to meet new levels of traffic.

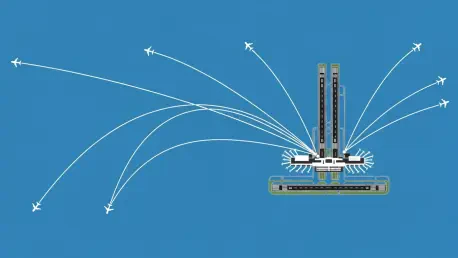

Further dissecting the operational triumphs of 2025, the airport’s success can be largely attributed to its continuous efforts to diversify connectivity and enhance its global reach. Throughout the year, the airport expanded its network to connect Malta with an impressive 111 airports across 37 different markets, providing travelers with unprecedented choice and convenience. This expansion was facilitated by a robust roster of 34 airlines, a figure that includes the successful integration of four new airline partners in 2025 alone. This strategic broadening of the airline portfolio is crucial, as it not only opens up new routes and markets but also significantly enhances the airport’s resilience. By reducing its dependence on any single airline or geographical region, Malta International Airport has built a more robust and flexible operational model, capable of weathering market fluctuations and capitalizing on emerging travel trends, ensuring long-term stability and growth potential.

Market Dynamics and Strategic Success

An in-depth examination of the market share for 2025 reveals a continued consolidation of dominance by low-cost carriers (LCCs), which collectively accounted for approximately 62.5% of all passenger traffic through the airport. Ryanair remains the undisputed market leader, responsible for an impressive 51% of all passenger movements. The airline significantly grew its traffic through Malta International Airport by 14%, carrying a total of 5.12 million passengers. In contrast, the national carrier, KM Malta Airlines, saw its traffic contract by 8% to 1.7 million passengers, securing a 17.3% market share. Geographically, the United Kingdom and Italy continue to serve as the cornerstone markets, each contributing 20% to the total passenger volume. However, a notable trend is the remarkable growth of the Polish market, which surged by an astonishing 49% to 860,000 passengers. This established it as the third-largest market with a 9% share, highlighting its rapidly growing strategic importance for the airport’s future growth plans.

A pivotal element of Malta International Airport’s growth story is its tangible success in addressing the long-standing challenge of seasonality, a critical strategic victory for both the airport and the wider Maltese tourism industry. The data for 2025 shows a clear and positive trend in this regard, with the growth rate during the “shoulder months”—defined as January to March and October to December—registering a robust 16%. This significantly outpaced the 11% growth recorded during the peak summer period. In absolute terms, the increase in passenger movements during these off-peak periods amounted to an additional 580,000 passengers, surpassing the 520,000 additional passengers handled during the summer months. This achievement demonstrates clear progress toward establishing Malta as a year-round destination, which in turn leads to more stable and predictable revenue streams and allows for more efficient utilization of airport infrastructure throughout the year, avoiding the strains of extreme peaks and troughs.

Charting the Course for Continued Expansion

Building on the monumental successes of the previous year, Malta International Airport has provided an optimistic and confident outlook for the 2026 calendar year. The company projects that total passenger movements will reach 10.5 million, representing a further growth of 4.4% over 2025’s record-setting figures. This anticipated growth is not merely organic but is directly linked to proactive and strategic network development. Key initiatives fueling this forecast include the introduction of new routes to destinations in Eastern and Northern Europe and Scandinavia, tapping into emerging markets with high growth potential. Furthermore, the landmark launch of direct flights to New York is set to be a game-changer, opening up a vital long-haul market and significantly enhancing Malta’s global connectivity. This forward-looking strategy demonstrates management’s commitment to not just maintaining momentum but actively seeking new avenues for sustainable expansion.

This positive traffic forecast translates directly into strong financial guidance for 2026, signaling the company’s confidence in maintaining a robust financial performance alongside its operational expansion. Malta International Airport anticipates generating total revenues of €162 million, which is 7.3% higher than the forecast issued for the previous year. Profitability is also expected to see healthy growth, with earnings before interest, taxes, depreciation, and amortization (EBITDA) projected to reach €98 million, a 5.3% increase over the prior year’s guidance. Net profit is anticipated to be €51 million, representing a 4.1% increase. These projections, when compared to pre-pandemic 2019 levels, are even more pronounced, with revenue up by 62% and profits up by over 50%. This demonstrates that the company has not only fully recovered but has also entered a new and accelerated phase of growth, driven by sound financial management and strategic foresight.

Bridging the Gap Between Performance and Valuation

The airport’s growth is being actively supported by a significant, multi-year capital investment program designed to future-proof its infrastructure and enhance capacity. For the period of 2025-2029, Malta International Airport has allocated an impressive €345 million for infrastructure development. In 2026 alone, capital expenditure is expected to amount to €90 million. This follows the successful completion of the westward terminal expansion in the first half of 2025. The focus for the current year will be on two major projects that are critical for accommodating the projected increase in passenger numbers: the construction of Sky Parks 2 and the eastward expansion of the terminal, which commenced at the end of 2025. These substantial investments are not merely about adding capacity; they are about enhancing the overall passenger experience, improving operational efficiency, and ensuring that the airport can sustain its growth trajectory for years to come.

Despite this overwhelmingly positive operational and financial news, a key paradox was identified: the company’s share price had remained largely stagnant, seldom breaking the €6 threshold over the past two years. This had been a source of frustration for many investors, who felt the market was overlooking the company’s strong fundamentals and clear growth trajectory. A potential future catalyst for the share price was posited to be increased clarity regarding the company’s major investment program. As the various phases of the expansion were completed, the company’s cash flow was expected to improve significantly. This, in turn, was anticipated to enable the distribution of much more meaningful dividend payments to shareholders, which could have finally attracted greater investor interest and led to a re-evaluation of the company’s stock, better aligning its market valuation with its impressive performance.Fixed version:

Malta International Airport has demonstrated an extraordinary period of growth, culminating in a landmark year that saw passenger traffic surpass all previous records and set a new benchmark for operational success. The airport’s strategic initiatives, which focus on expanding its network, mitigating seasonal lulls in travel, and undertaking significant infrastructure investments, have painted a clear picture of a company on a powerful upward trajectory. This robust performance, coupled with an optimistic forecast for the current year, underscores a period of sustained expansion. An analysis of its performance reveals a carefully managed growth strategy that has not only recovered from past global disruptions but has also propelled the airport into a new phase of development, even as its market valuation has yet to fully capture this fundamental strength. The narrative is one of strategic foresight and effective execution, positioning the airport as a key driver of Malta’s connectivity and economic vitality for the foreseeable future.

A Year of Unprecedented Growth

The 2025 calendar year was a historic period for Malta International Airport, officially cementing its status as a leading regional hub by handling a total of 10.06 million passenger movements. This significant milestone represented a substantial 12.3% increase over the previous record set in 2024, a testament to the surging demand for travel to the Maltese islands. This growth was underpinned by a deliberate and strategic increase in airline capacity, with available seats rising by just over 13% compared to the prior year. Despite this considerable expansion, the airport maintained remarkable operational efficiency, achieving a seat load factor of 85.4%. While this figure marks a slight decrease, it remains an exceptionally healthy indicator, signifying that the vast majority of available seats were filled and that the growth was both managed and sustainable, reflecting a perfect synergy between supply and high consumer demand. This performance highlights the airport’s ability to effectively scale its operations to meet new levels of traffic.

Further dissecting the operational triumphs of 2025, the airport’s success can be largely attributed to its continuous efforts to diversify connectivity and enhance its global reach. Throughout the year, the airport expanded its network to connect Malta with an impressive 111 airports across 37 different markets, providing travelers with unprecedented choice and convenience. This expansion was facilitated by a robust roster of 34 airlines, a figure that includes the successful integration of four new airline partners in 2025 alone. This strategic broadening of the airline portfolio is crucial, as it not only opens up new routes and markets but also significantly enhances the airport’s resilience. By reducing its dependence on any single airline or geographical region, Malta International Airport has built a more robust and flexible operational model, capable of weathering market fluctuations and capitalizing on emerging travel trends, ensuring long-term stability and growth potential.

Market Dynamics and Strategic Success

An in-depth examination of the market share for 2025 reveals a continued consolidation of dominance by low-cost carriers (LCCs), which collectively accounted for approximately 62.5% of all passenger traffic through the airport. Ryanair remains the undisputed market leader, responsible for an impressive 51% of all passenger movements. The airline significantly grew its traffic through Malta International Airport by 14%, carrying a total of 5.12 million passengers. In contrast, the national carrier, KM Malta Airlines, saw its traffic contract by 8% to 1.7 million passengers, securing a 17.3% market share. Geographically, the United Kingdom and Italy continue to serve as the cornerstone markets, each contributing 20% to the total passenger volume. However, a notable trend is the remarkable growth of the Polish market, which surged by an astonishing 49% to 860,000 passengers. This established it as the third-largest market with a 9% share, highlighting its rapidly growing strategic importance for the airport’s future growth plans.

A pivotal element of Malta International Airport’s growth story is its tangible success in addressing the long-standing challenge of seasonality, a critical strategic victory for both the airport and the wider Maltese tourism industry. The data for 2025 shows a clear and positive trend in this regard, with the growth rate during the “shoulder months”—defined as January to March and October to December—registering a robust 16%. This significantly outpaced the 11% growth recorded during the peak summer period. In absolute terms, the increase in passenger movements during these off-peak periods amounted to an additional 580,000 passengers, surpassing the 520,000 additional passengers handled during the summer months. This achievement demonstrates clear progress toward establishing Malta as a year-round destination, which in turn leads to more stable and predictable revenue streams and allows for more efficient utilization of airport infrastructure throughout the year, avoiding the strains of extreme peaks and troughs.

Charting the Course for Continued Expansion

Building on the monumental successes of the previous year, Malta International Airport has provided an optimistic and confident outlook for the 2026 calendar year. The company projects that total passenger movements will reach 10.5 million, representing a further growth of 4.4% over 2025’s record-setting figures. This anticipated growth is not merely organic but is directly linked to proactive and strategic network development. Key initiatives fueling this forecast include the introduction of new routes to destinations in Eastern and Northern Europe and Scandinavia, tapping into emerging markets with high growth potential. Furthermore, the landmark launch of direct flights to New York is set to be a game-changer, opening up a vital long-haul market and significantly enhancing Malta’s global connectivity. This forward-looking strategy demonstrates management’s commitment to not just maintaining momentum but actively seeking new avenues for sustainable expansion.

This positive traffic forecast translates directly into strong financial guidance for 2026, signaling the company’s confidence in maintaining a robust financial performance alongside its operational expansion. Malta International Airport anticipates generating total revenues of €162 million, which is 7.3% higher than the forecast issued for the previous year. Profitability is also expected to see healthy growth, with earnings before interest, taxes, depreciation, and amortization (EBITDA) projected to reach €98 million, a 5.3% increase over the prior year’s guidance. Net profit is anticipated to be €51 million, representing a 4.1% increase. These projections, when compared to pre-pandemic 2019 levels, are even more pronounced, with revenue up by 62% and profits up by over 50%. This demonstrates that the company has not only fully recovered but has also entered a new and accelerated phase of growth, driven by sound financial management and strategic foresight.

Bridging the Gap Between Performance and Valuation

The airport’s growth is being actively supported by a significant, multi-year capital investment program designed to future-proof its infrastructure and enhance capacity. For the period of 2025-2029, Malta International Airport has allocated an impressive €345 million for infrastructure development. In 2026 alone, capital expenditure is expected to amount to €90 million. This follows the successful completion of the westward terminal expansion in the first half of 2025. The focus for the current year will be on two major projects that are critical for accommodating the projected increase in passenger numbers: the construction of Sky Parks 2 and the eastward expansion of the terminal, which commenced at the end of 2025. These substantial investments are not merely about adding capacity; they are about enhancing the overall passenger experience, improving operational efficiency, and ensuring that the airport can sustain its growth trajectory for years to come.

Despite this overwhelmingly positive operational and financial news, a key paradox was identified: the company’s share price had remained largely stagnant, seldom breaking the €6 threshold over the past two years. This had been a source of frustration for many investors, who felt the market was overlooking the company’s strong fundamentals and clear growth trajectory. A potential future catalyst for the share price was posited to be increased clarity regarding the company’s major investment program. As the various phases of the expansion were completed, the company’s cash flow was expected to improve significantly. This, in turn, was anticipated to enable the distribution of much more meaningful dividend payments to shareholders, which could have finally attracted greater investor interest and led to a re-evaluation of the company’s stock, better aligning its market valuation with its impressive performance.