In an era where digital threats loom larger than ever, the financial sector faces an unprecedented challenge to safeguard its operations against sophisticated cyberattacks, with human error often being the weakest link in the chain of defense. As regulatory frameworks like the Digital Operational Resilience Act (DORA), which became mandatory earlier this year, set stringent standards for cybersecurity, financial institutions are realizing that technology alone cannot shield them from disruptions. The real strength lies in empowering employees to act as the first line of defense. A well-trained workforce, equipped with the right skills and awareness, can significantly enhance an organization’s ability to withstand, respond to, and recover from IT-related incidents. This growing recognition of human capital’s role in digital resilience marks a pivotal shift in how the industry approaches cybersecurity, blending technological solutions with behavioral readiness to create a robust shield against evolving threats.

Strengthening Defenses Through Human Capital

Building a Security-First Mindset

The foundation of digital resilience in the financial sector starts with cultivating a security-first mindset among employees, a critical step in addressing the vulnerabilities that human error can introduce. With studies indicating that a staggering 70% to 95% of cyber incidents stem from mistakes or oversight by staff, the urgency to prioritize training cannot be overstated. Comprehensive programs that educate employees on recognizing phishing attempts, securing sensitive data, and adhering to protocols under DORA are essential. These initiatives go beyond mere compliance; they aim to transform staff into active participants in safeguarding their organizations. By embedding cybersecurity awareness into daily routines, companies can reduce the likelihood of breaches triggered by simple lapses, such as clicking on malicious links. This proactive approach ensures that every individual understands their role in maintaining the integrity of digital operations, fostering a culture where vigilance is second nature.

Fostering Proactive Threat Detection

Beyond basic awareness, empowering employees to detect and respond to threats proactively is a game-changer for financial institutions striving to meet DORA’s rigorous standards. Simulated exercises, such as phishing drills and real-world threat scenarios, provide hands-on experience that sharpens staff’s ability to identify suspicious activities before they escalate. These practical training methods not only build confidence but also reveal gaps in readiness that can be addressed before a real crisis unfolds. When employees are equipped to spot anomalies—whether in emails, transactions, or system behavior—they become an invaluable asset in preempting disruptions. Moreover, encouraging a mindset of continuous learning ensures that staff remain agile in the face of new and evolving cyber tactics. This dynamic preparation aligns with the operational resilience testing mandated by DORA, positioning organizations to not only comply with regulations but also to stay ahead of potential risks in a rapidly changing digital landscape.

Cultivating a Collaborative Resilience Culture

Enhancing Incident Reporting Efficiency

A cornerstone of achieving compliance with DORA lies in the efficiency of incident reporting, where employee readiness plays an indispensable role in minimizing damage from cyber incidents. Under the regulation, financial entities must notify authorities within strict timelines—often as little as four hours after identifying a major issue. Training staff to recognize and report anomalies swiftly can drastically cut down containment time, protecting both financial assets and reputational standing. This requires clear communication channels and a non-punitive environment where employees feel safe to flag concerns without fear of repercussions. When every team member understands the importance of rapid response and is familiar with the reporting process, the organization can mitigate the impact of disruptions more effectively. Such preparedness not only ensures adherence to regulatory mandates but also builds trust in the system, reinforcing the idea that every report contributes to a stronger defense mechanism across the board.

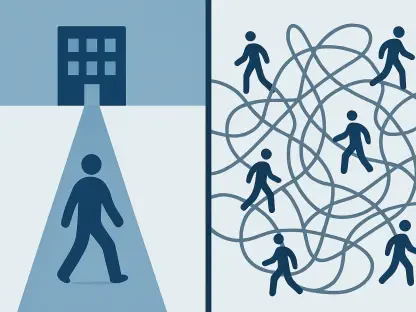

Promoting Information Sharing Networks

Another vital aspect of resilience is the promotion of information sharing within and beyond organizational boundaries, creating a collaborative network that benefits the entire financial ecosystem. Encouraging employees to report suspicious activities through accessible tools and transparent processes helps build an internal threat intelligence framework that informs decision-making. When staff are empowered to share insights about emerging risks or near-miss incidents, it fosters a culture of collective responsibility. Extending this collaboration industry-wide, as encouraged by DORA’s framework, amplifies the impact—allowing organizations to learn from shared experiences and adapt to new threats more effectively. This interconnected approach transforms isolated efforts into a unified front against cyberattacks, ensuring that knowledge and best practices ripple through the sector. By prioritizing such networks, financial institutions can enhance their resilience, turning individual vigilance into a powerful, sector-wide shield against digital disruptions.

Advancing Toward a Resilient Future

Innovating Training for Long-Term Impact

Looking back, the financial sector’s journey toward digital resilience under DORA revealed that innovative training methods were pivotal in preparing employees for the complexities of cyber threats. Cross-sector workshops and inter-company threat simulations stood out as effective strategies that deepened staff expertise while fostering a broader understanding of industry challenges. These initiatives went beyond traditional training, incorporating advanced behavioral analytics to tailor learning experiences to individual needs. By simulating real-world scenarios, organizations ensured that their workforce was not just reacting to threats but anticipating them with informed decision-making. This forward-thinking approach proved essential in maintaining compliance while building a sustainable defense against evolving risks. The focus on continuous education underscored a commitment to long-term resilience, setting a benchmark for how human capital could drive security standards.

Sustaining Momentum Through Strategic Investments

Reflecting on past efforts, strategic investments in employee development emerged as a linchpin for sustaining digital resilience in the financial sector. Beyond initial training, organizations that prioritized ongoing skill enhancement through regular updates and access to cutting-edge tools saw significant improvements in their ability to adapt to new threats. Cultivating a culture of transparency and collaboration ensured that lessons learned from past incidents informed future strategies, creating a feedback loop of improvement. Moving forward, financial institutions should consider deepening these investments by integrating emerging technologies like AI-driven training platforms to personalize learning further. Partnering with industry peers for shared simulations can also amplify preparedness, ensuring a collective rise in standards. These steps, grounded in the successes of earlier initiatives, offer a clear path to not only meet regulatory demands but also protect against the unpredictable nature of cyber risks in the years ahead.