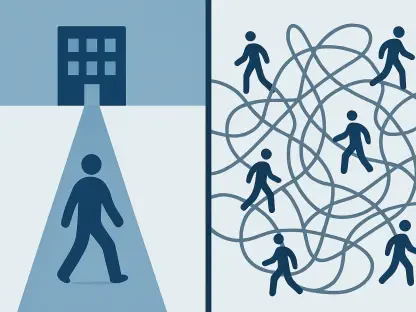

The intricate web of human resources compliance has become significantly more tangled this year, presenting organizational leaders with an unprecedented series of regulatory hurdles that demand immediate and strategic attention. Following a tumultuous 2025, the current landscape is marked by an acceleration of legislative fragmentation, particularly at the state level, which runs parallel to the introduction of new federal mandates. This convergence creates substantial administrative burdens that impact everything from payroll to talent management. For organizations aiming to thrive, navigating these complex and often conflicting requirements is not merely an administrative task but a critical component of strategic planning and risk management, demanding a proactive rather than reactive approach to ensure continued operational stability and legal soundness.

Navigating New Federal Tax and Reporting Complexities

A significant source of administrative difficulty for HR teams this year stems directly from the 2025 tax law, officially known as the “One Big, Beautiful Bill Act,” which introduces nuanced changes for the 2026 tax year. This legislation created new tax deductions for workers covering the 2025 through 2028 tax years. While beneficial for employees, these provisions place a considerable reporting burden on employers. A qualified tip deduction, for instance, is now available to workers in approximately 70 specific occupations, but it comes with a $25,000 annual cap and requires married individuals to file jointly. Similarly, a separate deduction for the premium portion of overtime pay applies only to federally mandated time-and-a-half compensation under the Fair Labor Standards Act (FLSA), excluding overtime paid under more generous state laws. Although the IRS announced temporary penalty relief in November 2025 for these new reporting requirements, advisors are cautioning employers against complacency, urging them to proactively prepare for necessary modifications to Form W-2 reporting.

The Expanding Patchwork of State Mandates

The persistent trend of states enacting and expanding their own paid leave laws creates a formidable compliance challenge, especially for organizations that operate across multiple state lines. More than a dozen states now mandate paid sick leave, with several implementing notable modifications this year. For example, California broadened its law to cover victims of serious crimes, while Connecticut lowered its employer size threshold from 25 to 11 employees, making the law applicable to a larger number of businesses. Oregon also expanded its qualifying reasons for leave to include blood donation. This proliferation of state-specific laws presents a logistical minefield for multi-state employers, who must now administer a complex web of varying accrual rules, employee notification requirements, and recordkeeping standards for each jurisdiction, demanding robust and flexible HR systems to avoid costly errors.

This state-led movement extends forcefully into retirement security, with a growing number of mandates compelling employers to offer a workplace retirement plan. Thirteen states now have fully active programs, and 2026 sees further implementation with Minnesota conducting a soft launch of its program on January 1 and New York’s first registration deadline passing on March 18. Employers in these states face a clear choice: register for the state-facilitated plan or implement a private plan, such as a 401(k), that satisfies the mandate. Concurrently, a major federal change is on the horizon for 2027 with the SECURE Act 2.0. This act will transform the existing Saver’s Credit into a “Saver’s Match,” providing a direct federal matching contribution of up to $1,000 into an eligible individual’s retirement account. Employers sponsoring 401(k) plans who wish to allow their employees to receive these funds will need to amend their plan documents and coordinate with recordkeepers to accept and process these government contributions.

The Uncharted Territory of AI Regulation

The regulation of artificial intelligence in the workplace is an emerging and highly contested field, characterized by a growing tension between federal ambitions and state-level action. A significant development occurred on December 11, when an executive order was signed to establish federal authority over AI regulation, directing the Department of Justice to create the infrastructure necessary to preempt state AI laws. This move grants the DOJ discretionary power to assess the constitutionality of state legislation and pursue litigation against those it deems overly restrictive. This federal initiative comes as states are actively leading the regulatory charge, with at least 22 having pending legislation concerning deepfakes, disclosure requirements, and child safety. The executive order could therefore significantly impact or invalidate many of these state-level protections, leaving employers in a state of uncertainty.

A pivotal compliance event for 2026 is the implementation of California’s new rules on automated decision-making technology (ADMT), which fall under the California Consumer Privacy Act. Effective January 1, with a phased compliance schedule, these rules impose new obligations on covered employers who use automated tools for significant employment decisions, such as hiring, promotion, or termination, without meaningful human involvement. These employers are now required to complete comprehensive risk assessments to evaluate the potential for bias or other harms. Furthermore, they must provide advance notice to employees about the use of such technology and, in many cases, offer workers the ability to opt out of these automated processes. This landmark legislation sets a high bar for transparency and accountability in the use of AI in HR and may serve as a model for other states, regardless of federal preemption efforts.

Addressing Economic Pressures and Political Instability

The convergence of widespread minimum wage increases and federal fiscal uncertainty presented a dual challenge for leaders this year. Nearly 20 states implemented minimum wage hikes, with the majority taking effect on January 1. In addition, several major metropolitan areas within California, New York, and other states also saw their local minimum hourly wages rise. These changes required HR departments to meticulously update payroll systems, adjust budgets, and in some cases, re-evaluate hiring strategies to absorb the increased labor costs. Simultaneously, the risk of a partial federal government shutdown loomed as the funding agreement from November 2025 was set to expire on January 30. A key point of contention in those negotiations involved the enhanced premium tax credits for the Affordable Care Act (ACA). The debate itself demonstrated how changes to these subsidies could indirectly but significantly impact Applicable Large Employers (ALEs) by altering their potential liability under the Employer Shared Responsibility provisions, making fiscal stability a critical watchpoint for HR compliance.