In today’s rapidly evolving business environment, the demand for efficient payroll systems has grown significantly, presenting both challenges and opportunities for HR leaders. As organizations strive to navigate the complexities of multistate compliance while maintaining employee satisfaction, the role of payroll software in the human resources landscape becomes increasingly crucial. These systems not only shape business outcomes but also play a pivotal role in enhancing employee experience. By modernizing payroll software, HR leaders can effectively address current demands, streamline operations, and align business strategies with broader organizational goals. This advancement in technology transforms payroll from a basic administrative function into a strategic asset, serving as a foundation for constructing a competitive advantage in the marketplace.

Automation Enhances Payroll Accuracy

Payroll accuracy is integral to maintaining employee trust and minimizing the burden of error correction processes. Traditional systems, heavily reliant on manual data entry and spreadsheets, are prone to inaccuracies that can be costly and time-consuming. A study by G2 underscores the importance of automation, revealing that 40% of payroll errors stem from manual inputs. By integrating time and attendance data from core HR systems and automating payroll processes, businesses can substantially reduce these errors. Automation allows for the seamless application of business rules concerning overtime, deductions, and local tax codes, and flags anomalies for review before processing. Enhancing payroll accuracy not only mitigates employee disengagement and attrition but also strengthens the relationship between employer and employee. Nearly a quarter of employees consider leaving their jobs after experiencing payroll mistakes, highlighting the critical need for precision in payroll management.

Furthermore, the automation of payroll operations directly influences business outcomes by promoting operational efficiency. With streamlined processes, HR teams can shift their focus from transactional tasks to strategic initiatives, fostering a more productive workforce. Automation reduces the risk of compliance breaches by ensuring adherence to federal, state, and local payroll regulations. Modern systems are equipped to automatically update tax codes and enforce relevant labor laws, thereby minimizing the need for extensive manual oversight. This reliability mitigates the risk of penalties and fosters a sense of security among employees. By investing in robust automation capabilities, organizations can improve accuracy, bolster compliance efforts, and ultimately enhance employee satisfaction and retention.

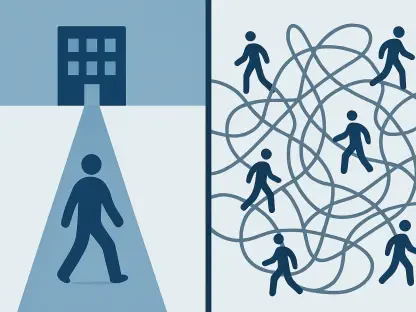

Navigating Multistate Compliance

Managing the complexities of multistate compliance is a daunting challenge for HR leaders, especially in an era marked by an increasingly remote and distributed workforce. Federal, state, and local payroll rules vary significantly, adding layers of complexity to the payroll management process. Modern payroll software equips businesses with the tools to seamlessly navigate these terrains, applying appropriate wage laws, tax rules, and labor regulations based on each employee’s location. This capability substantially reduces compliance errors and mitigates risks associated with non-compliance. Compliance management is further bolstered by platforms that provide secure audit trails, facilitating a transparent oversight mechanism to ensure ongoing adherence.

Modern payroll solutions offer automatic updates for tax codes, local labor rules, and other regulatory requirements, thereby ensuring that organizations remain continuously compliant. For HR leaders, this decreases the amount of manual oversight required to maintain compliance and reduces exposure to potential legal repercussions. The integration of compliance features within payroll systems ensures that HR teams can focus on broader organizational goals without being hindered by governmental complexities and regulatory changes. Moreover, advanced compliance capabilities foster trust among employees, reinforcing their sense of security within the organization. Through effective compliance management, businesses cultivate an environment where employees feel confident in their pay and benefits, bolstering both morale and productivity.

Enhancing Employee Experience

Self-service portals have emerged as a vital component in elevating the employee experience within organizations. By offering convenient access to pay information, these portals empower employees with greater control over their personal data and enhance transparency. This level of accessibility reduces frustration and significantly cuts down on HR help desk cases, ultimately building trust and strengthening employee value propositions. Employees can view pay stubs, check paid time off (PTO) balances, update banking details, and download necessary tax forms in real-time, directly through these portals. This modern, user-friendly experience liberates HR teams from routine transaction management, allowing them to channel their efforts into more strategic initiatives.

The implementation of self-service portals not only simplifies the employee experience but also contributes to a positive workplace culture. By offering seamless access to critical payroll information, organizations demonstrate a commitment to transparency and respect for their employees’ autonomy. This empowerment builds stronger connections between employers and their workforce, enhancing engagement and loyalty. Furthermore, the shift towards self-service reduces administrative burdens on HR teams, freeing resources to focus on initiatives that drive business success. By embracing modern payroll software with robust self-service capabilities, companies can effectively improve their employee experience, fostering a more engaged and satisfied workforce.

Streamlined Onboarding Process

The integration of payroll automation during the onboarding process is essential for ensuring new hires receive accurate and timely compensation. A streamlined onboarding process not only creates a positive first impression but also contributes to overall workforce stability. By automating data entry and syncing payroll eligibility with hire dates, HR leaders can efficiently manage onboarding cycles, fostering trust and reducing early attrition risks. Metrics such as onboarding cycle time and new hire engagement scores provide measurable insights into the positive impact of payroll automation on organizational performance.

A seamless onboarding process is invaluable to both new employees and HR teams. Automating payroll functions helps eliminate errors and inconsistencies, which could otherwise undermine trust and lead to dissatisfaction. Additionally, expedited onboarding processes enable new employees to focus on their roles without financial distractions, enhancing productivity from day one. Employers benefit from reduced turnover and improved employee engagement, driving long-term success and growth. By investing in payroll automation, organizations position themselves to attract and retain top talent, creating a strong foundation for future achievements.

Operational Efficiency through Integration

Effective system integration is a key advantage of modern payroll software, enhancing operational efficiency and supporting strategic decision-making. Linking payroll systems with financial planning, analysis, and workforce planning tools provides accurate, real-time data that informs budgeting, headcount forecasting, and compensation planning. This integration showcases the strategic value of HR technology investments, empowering HR teams to contribute to organizational goals. The connectivity between payroll and accounting systems, scheduling tools, and other relevant platforms reduces reconciliation delays and enhances workforce analytics.

The benefits of system integration extend beyond operational efficiency, influencing broader business decisions through robust data insights. By facilitating access to comprehensive and timely information, HR teams are better equipped to make informed decisions regarding compensation strategies, workforce management, and organizational goals. Payroll integration promotes collaboration between HR and other departments, driving innovation and optimizing performance outcomes. In today’s fast-paced business environment, accurate data is crucial for competitive advantage, and integrated systems provide a platform for strategic initiatives. Organizations can leverage these efficiencies to continuously adapt to changing market demands and maintain their footing in an increasingly competitive landscape.

Strategies for Implementation and Upgrade

Successfully implementing or upgrading payroll software requires careful consideration and strategic planning. Effective change management is essential, with HR leaders tasked with early and clear communication about the expected benefits and improvements. Gathering feedback from Payroll and Finance departments before rolling out new systems is crucial for refining processes and ensuring alignment with organizational goals. When evaluating vendors, the decision to extend existing HR platforms or incorporate a best-in-class payroll solution should be guided by an assessment of support services, implementation capabilities, and compliance features.

Comprehensive training and adoption strategies are vital for maximizing system functionality across endpoints. By ensuring payroll teams and employees are well-versed in the new software, organizations can enhance performance and drive engagement. Additionally, auditing current payroll systems is critical for identifying manual processes and compliance gaps that may hinder effectiveness. By conducting a vendor market scan, organizations can determine if their existing software meets the demands of a distributed, fast-paced workforce. Addressing these areas strategically can mitigate risk, improve operational effectiveness, and position HR teams to deliver strategic value across organizations.

Transformative Role of Payroll Software

Ensuring payroll accuracy is crucial for maintaining employee trust and reducing the complications associated with correcting errors. Traditional payroll systems that depend on manual data entry and spreadsheets are notoriously prone to mistakes, leading to significant time and financial costs. A study by G2 highlights that 40% of payroll errors originate from manual entry. By automating and integrating time and attendance data from HR systems, companies can significantly diminish these errors. Automation streamlines the application of policies related to overtime, deductions, and tax codes, while flagging discrepancies for review. Accurate payroll prevents employee discontent and turnover, as nearly 25% of employees contemplate leaving due to payroll errors, underscoring the need for precision. Moreover, automating payroll processes enhances business efficiency, allowing HR to focus on strategic goals rather than tedious tasks. It also mitigates compliance risks by ensuring adherence to payroll regulations. Investing in automation enhances accuracy, compliance, and overall employee satisfaction and retention.