In a world increasingly defined by upheaval, Australia’s supply chain sector stands at a critical crossroads, grappling with challenges that test its very foundation while seeking pathways to thrive amid relentless disruption. Geopolitical tensions, economic fluctuations, and climate crises have woven a complex web of volatility that no longer appears as a temporary hurdle but as a permanent state of affairs. The pressing question emerges: can the nation’s logistics and trade systems adapt to this unpredictable landscape? This article delves into the multifaceted issues facing the industry, from global trade shifts to domestic shortcomings, while exploring the opportunities and strategies needed to build resilience. With unpredictability now the baseline, the focus must shift from chasing stability to crafting systems that endure and even capitalize on constant change. The stakes are high, as failure to adapt risks not only economic setbacks but also missed chances to position Australia as a leader in a transformed global market.

Global Challenges and Opportunities

Persistent Volatility

The New Baseline of Disruption

Australia’s supply chain operations are navigating an era where disruption is no longer an exception but the rule, driven by a convergence of geopolitical unrest, economic instability, and climate-related challenges. Global trade routes, once predictable, now face constant interruptions from shifting policies and international conflicts, leading to delays in shipping and container imbalances that ripple through to local businesses. Climate events, such as floods and droughts, further complicate logistics by damaging infrastructure and disrupting agricultural output, a key pillar of the export economy. These factors create a cascading effect, where a single delay in one region can stall operations across the entire network. The reality is stark: planning for a stable future is obsolete, and the industry must instead prepare for a state of perpetual flux, where adaptability becomes the cornerstone of survival in a landscape defined by uncertainty.

Opportunities Amid Uncertainty

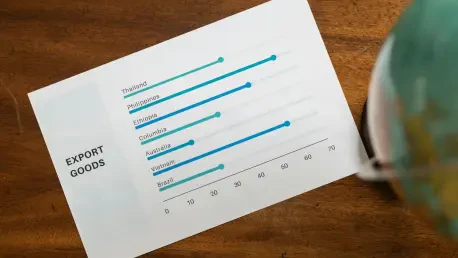

Despite the daunting challenges, volatility has carved out unexpected opportunities for Australia’s exporters, particularly in the agricultural sector, where global market shifts have created new demand. Notably, China’s reorientation away from certain US agricultural imports has led to a surge in appetite for Australian products like grain-fed beef and almonds, positioning the nation as a key supplier in a reshaped trade dynamic. However, this silver lining comes with a cautionary note—relying too heavily on a single market is a dangerous gamble, especially as trade priorities can pivot swiftly due to geopolitical or policy changes. Diversification of export destinations and products is essential to mitigate risks and ensure long-term stability. While these openings provide a much-needed boost, they underscore the need for strategic planning to balance immediate gains with sustainable growth, preventing overexposure to any one market’s fluctuations.

Emerging Trade Horizons

Capitalizing on Global Shifts

The reshaping of global trade patterns offers a unique window for Australia to strengthen its position as a reliable supplier, especially as traditional alignments falter under geopolitical pressures. Markets once dominated by other nations are now accessible, with Australian agricultural goods filling gaps left by competitors, driven by both quality and strategic trade agreements. Yet, this advantage demands agility—exporters must stay ahead of rapidly changing regulations and consumer trends to maintain relevance. Building robust relationships with multiple trading partners can safeguard against sudden policy shifts or economic downturns in any single region. This proactive approach to market expansion is not just about seizing current opportunities but also about laying the groundwork for resilience against future disruptions, ensuring the supply chain can pivot as global dynamics evolve.

Mitigating Risks of Market Dependence

While new trade opportunities are promising, the inherent risks of over-dependence on specific markets cannot be ignored, as history has shown how quickly economic or political tides can turn. A sudden shift in a major partner’s priorities—whether due to domestic policy changes or international decarbonization goals—could leave Australian exporters vulnerable to significant losses. To counter this, a deliberate strategy of diversification must be prioritized, spreading trade across varied regions and sectors to buffer against localized shocks. Investments in market research and diplomatic trade ties can help identify and secure alternative destinations for key exports. This balanced approach not only reduces exposure to volatility in any one area but also fosters a more adaptable export framework capable of withstanding the unpredictable nature of global commerce.

Domestic Struggles and Systemic Gaps

Infrastructure and Policy Shortfalls

Ambition vs. Reality

Australia’s supply chain infrastructure faces a frustrating disconnect between ambitious policy goals and the sluggish pace of real-world implementation, leaving the system reliant on overtaxed and outdated networks. Federal initiatives to diversify freight through increased rail and intermodal transport are commendable in intent, aiming to reduce emissions and ease congestion, yet the rollout remains painfully slow. Road networks, bearing the brunt of logistics traffic, suffer from wear and bottlenecks, creating inefficiencies that delay goods and inflate costs. This lag in modernizing transport options hampers the sector’s ability to respond to sudden demand spikes or disruptions. Without accelerated action to bridge this gap, the nation risks falling behind global peers who are rapidly upgrading their logistics frameworks to handle similar challenges with greater efficiency.

Economic Strain on Operators

The burden of infrastructure delays and policy inaction falls heavily on small and medium enterprises (SMEs), which form a critical backbone of Australia’s supply chain but lack the resources to absorb mounting operational costs. Rising fuel prices, labor expenses, and regulatory compliance demands compound the strain, particularly as road-centric logistics amplify inefficiencies and downtime. Unlike larger corporations with deeper financial reserves, SMEs often operate on razor-thin margins, making them vulnerable to even minor disruptions. This economic pressure not only threatens their survival but also weakens the broader supply chain ecosystem by reducing diversity and resilience among operators. Addressing these systemic gaps through targeted support and faster infrastructure upgrades is crucial to leveling the playing field and ensuring that all players can navigate the volatile landscape without being pushed to the brink.

Workforce and Capability Crisis

Beyond Labor Shortages

The workforce challenges facing Australia’s supply chain sector extend far beyond a simple lack of workers, revealing a deeper crisis of skills and readiness that threatens long-term adaptability. Many roles now require proficiency in advanced technologies like automation and data analytics, yet training programs often remain outdated, failing to equip employees with the necessary expertise. Additionally, unclear career progression paths deter talent from entering or staying in the industry, exacerbating turnover and knowledge loss. This gap in capability hinders the sector’s ability to modernize and respond to complex challenges, leaving operations stuck in inefficient practices. Addressing this issue demands a fundamental rethink of how talent is nurtured, ensuring that human capital is aligned with the evolving demands of a tech-driven and volatile environment.

Skills as Infrastructure

Recognizing workforce skills as a form of critical infrastructure is essential to fortifying Australia’s supply chain against ongoing uncertainty, requiring a collaborative push from industry and educational institutions. Partnerships between businesses and universities or vocational programs can design curricula that directly address current needs, such as training in AI-driven logistics tools or sustainable practices. Moreover, establishing clear career ladders within the sector can attract and retain talent by offering meaningful growth opportunities. Government support through funding or incentives for upskilling initiatives would further amplify these efforts, ensuring a pipeline of capable leaders ready to tackle disruption. By investing in human capital with the same urgency as physical infrastructure, the industry can build a foundation of resilience, empowering workers to drive innovation and adaptability in the face of constant change.

Technological and Competitive Pressures

Uneven Tech Adoption

Automation’s Unequal Reach

Technology holds transformative potential for Australia’s supply chain, yet its adoption remains frustratingly uneven across different segments, creating disparities in efficiency and competitiveness. Warehouses and distribution centers have increasingly embraced automation and predictive analytics to streamline inventory and reduce errors, reaping benefits in speed and cost savings. In contrast, many transport operators lag behind, clinging to manual processes or outdated tools like basic spreadsheets due to limited resources or know-how. This digital divide not only slows down the broader network but also leaves smaller players struggling to keep pace with tech-savvy competitors. Bridging this gap requires targeted support to ensure that all sectors can access and implement modern solutions, leveling the playing field and enhancing overall system performance.

Data Over Duplication

Beyond adoption, the effective use of technology in supply chains hinges on integrating data systems rather than allowing redundant or fragmented tools to proliferate, which often adds complexity instead of clarity. Many operators struggle with siloed information, where disparate platforms fail to communicate, leading to inefficiencies and missed insights. A focus on unified data ecosystems—where real-time information flows seamlessly across logistics stages—can optimize decision-making and reduce delays. This shift demands not just investment in software but also training to ensure staff can leverage these tools effectively. By prioritizing integration over duplication, the industry can unlock the full potential of digital advancements, turning data into a strategic asset that enhances responsiveness in an environment where every second counts amidst ongoing disruptions.

Market Dynamics and Economic Imbalance

Freight Market Under Stress

Economic pressures within Australia’s freight market are intensifying, as mergers, acquisitions, and business failures reshape the competitive landscape, often to the detriment of smaller operators and overall service quality. Cost volatility and demand fluctuations have driven consolidation, with larger firms absorbing struggling competitors, reducing diversity in the sector. Additionally, contractual imbalances—such as short credit terms imposed by service providers contrasted with extended payment demands from shippers—create cash flow challenges that disproportionately harm SMEs. This erosion of competition tends to favor big players, leading to higher pricing and reduced innovation in services. Tackling these inequities through fairer contract standards and support for smaller businesses is vital to maintaining a vibrant, competitive market that can withstand economic shocks.

Building Resilience Over Stability

The broader shift in mindset from seeking stability to fostering resilience has become a defining imperative for the supply chain sector, especially under the weight of economic and competitive pressures. Rather than designing systems for a predictable environment, the focus must be on flexibility—creating networks that can pivot quickly in response to market shifts or sudden disruptions. This involves diversifying supplier bases, building redundancies into critical operations, and fostering a culture of continuous adaptation. While efficiency remains important, it cannot come at the expense of agility, as rigid systems are ill-equipped to handle the unpredictability of today’s landscape. Embracing this resilience-driven approach ensures that the industry can not only endure ongoing challenges but also position itself to seize emerging opportunities in a volatile global economy.

Pathways to a Resilient Future

Accelerating Systemic Change

Looking back, the journey of Australia’s supply chain sector through recent volatilities highlighted the urgent gaps in infrastructure, policy, and workforce readiness that had long been simmering beneath the surface. Reflecting on past efforts, it became evident that while ambitious plans for freight diversification and rail expansion were drafted, their slow implementation left operators reliant on overstretched road networks. Similarly, the workforce challenges exposed a critical oversight in treating skills as a secondary concern rather than a foundational asset. These lessons from recent years underscored that half-measures were insufficient against the backdrop of relentless global and local disruptions. The sector’s struggles served as a stark reminder that systemic change could no longer be delayed if the industry hoped to stand firm in an era of uncertainty.

Forging Ahead with Actionable Strategies

As the dust settled on past shortcomings, the path forward for Australia’s supply chain demands concrete, actionable steps to transform challenges into enduring strengths. Prioritizing rapid policy execution to bolster rail and intermodal transport can alleviate current strains while reducing environmental impact. Simultaneously, investing in workforce development through industry-education collaborations ensures a talent pool equipped for modern logistics demands. Technology adoption must be democratized, with support mechanisms to help smaller operators integrate digital tools effectively. Additionally, fostering fairer economic practices in the freight market can preserve competition and innovation. By committing to these strategies, the sector can build a resilient framework that not only withstands volatility but also positions Australia as a formidable player on the global stage, ready for whatever disruptions lie ahead.