As Europe hardens sustainability rules, a single question now shapes midmarket strategy and capital plans: can cloud ERP carry the weight of the Digital Product Passport and turn compliance into advantage? The industrial heart of Europe—midmarket manufacturers and distributors that build components, assemble systems, and move goods—faces a pivotal moment as product data becomes both a regulatory obligation and a competitive currency. A wave of mandates, led by the EU’s Digital Product Passport under the Ecodesign for Sustainable Products Regulation, is pushing firms to expose verifiable lifecycle information while continuing to deliver on cost, quality, and service.

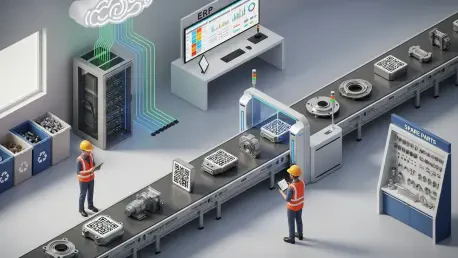

Pressure is mounting from every direction. Buyers want traceable materials and lower carbon footprints, regulators want harmonized disclosures and auditability, and partners expect near real-time data exchange. In the past, these demands would have pointed to bolt-on tools and manual reports. Now, the center of gravity has shifted: ERP—especially when extended in the cloud—has moved from a transactional engine to a compliance backbone that structures data, enforces controls, and connects the factory to the final mile and beyond.

Europe’s industrial midmarket sits at the center of this transformation. Original equipment makers, tiered suppliers, distributors, and recyclers all rely on midmarket firms to keep supply chains flowing, and their readiness determines how quickly the broader ecosystem can adapt. Cloud ERP promises a practical path—governed master data, integration at scale, and secure sharing—turning a regulatory hurdle into a foundation for circular business models.

Market Context And Strategic Stakes

The Digital Product Passport sits within a broader circular economy agenda and aligns with adjacent frameworks: CSRD for sustainability reporting, CSDDD for due diligence, updates to the Waste Framework, and the EU Battery Regulation. Together, they aim to standardize how product data is captured, verified, and exchanged across lifecycles. DPP starts with batteries and key metals in 2026 and 2027, then expands to textiles, furniture, chemicals, ICT equipment, and construction. That sequence tests the system on high-impact categories first, then scales into broader consumer and industrial domains.

Midmarket players bear the brunt of operational change because they manage granular bills of materials, outsourced steps, and frequent engineering revisions. The required data—composition, substances of concern, process energy, emissions, repairability, recyclability, and end-of-life directions—already exists in fragments across ERP, PLM, MES, WMS, and supplier portals. The opportunity is to consolidate it into a single source of truth, governed by master data policies and exposed through standard interfaces. In practice, cloud ERP is the most practical place to anchor this convergence.

Forterro’s European Industrial Midmarket findings underscored both urgency and uneven readiness. Roughly half of respondents reported that they understand or feel ready for DPP, while complexity, limited compliance resources, and unclear guidance were the most cited barriers. The signal is clear: firms do not lack data as much as structure, rules, and interoperable pathways. Cloud ERP brings all three if deployed with disciplined data modeling and integration patterns, rather than point-to-point customizations that break under change.

Operational Momentum And Emerging Trends

Performance drivers have shifted from efficiency-only programs to compliance-driven transformation. Instead of chasing narrow cost cuts, firms are now redesigning processes to deliver verified data at the pace of operations. This change is visible on the plant floor—where scrap, energy, and rework are measured not only for OEE but also for emissions baselines—and in procurement, where supplier attestations are tied to onboarding and replenishment.

At the same time, cloud platforms have become the preferred layer for secure, multi-party exchange. APIs, event streams, and data products enable firms to publish DPP fields to partners, connect to data-space initiatives such as Catena-X and Gaia-X, and absorb evolving schemas without core code rewrites. Interoperable standards are gaining traction, with GS1 Digital Link providing a bridge between a QR code on a product and structured data behind it, and EPCIS with Core Business Vocabulary supporting event-level traceability across the chain.

Buyer expectations continue to evolve toward products with lower carbon intensity and clear repair paths. Product identity technologies such as QR and NFC now unlock maintenance instructions, parts catalogs, and recycling guidance, turning products into gateways for information and service revenue. Moreover, these capabilities enable circular business models—repair, refurbishment, take-back, and materials recovery—that rely on durable, shareable product histories.

Forces Reframing Compliance And Operations

AI’s role has moved from experiment to utility. Practical applications include anomaly detection in emissions and material declarations, automated document parsing for supplier certifications, cybersecurity risk scoring, and predictive maintenance for high-wear assets. These tools, when embedded in ERP and supply chain suites, reduce manual review time, elevate data quality, and catch inconsistencies before they reach auditors or customers.

Security and trust have become foundational, not optional. Zero trust principles, identity and access management, and encryption at rest and in transit underpin exchanges with suppliers and regulators. Fine-grained access controls let firms share only what is needed, protect intellectual property, and meet consent requirements. Cloud ERP vendors have invested heavily here, which simplifies compliance for firms without large internal security teams.

Indicators, Benchmarks, And Timelines

Cloud adoption remains a work in progress. Less than half of midmarket firms reported being fully cloud, with many running hybrid architectures that mix on-prem modules with hosted services. Hybrids can meet near-term needs but often increase integration overhead and governance complexity. Given the DPP timeline—batteries and metals in the 2026–2027 window, rapid expansion thereafter—migration plans need acceleration to avoid last-minute workarounds.

Key metrics are emerging. Data completeness and quality, supplier onboarding rates, auditability of change histories, time-to-report, and cost-to-comply are proving more useful than traditional project milestones. Firms tracking these indicators are translating compliance into operational performance and uncovering root causes in upstream data capture, rather than treating late-stage reporting as a separate project.

Execution Hurdles And Practical Paths

Data fragmentation remains the hardest problem. Product attributes sit in different systems, taxonomies vary by business unit, and critical lifecycle values—like composition tolerances or refurbishability—are missing or unverified. Without a governed data model anchored in ERP, even the best analytics will surface contradictions rather than clarity. The immediate task is to map DPP fields to existing ERP objects and close gaps with material attribute enrichment and supplier data onboarding.

Integration complexity is next. Supplier portals, PLM and LCA tools, logistics and warehouse systems, and end-of-life partners must exchange data at new frequencies. The old pattern of custom interfaces does not scale. Cloud connectivity, standard APIs, and event-driven designs make it possible to align with evolving DPP schemas and adjacent mandates without redesigning the core each time a field changes.

Resource constraints are real. Compliance teams are small, ERP and AI expertise is scarce, and operations leaders juggle throughput requirements with new documentation demands. Cultural resistance adds friction; logistics, finance, and production teams experience change fatigue, while ownership of data domains can be unclear. Addressing this requires leadership-led change management and role-based training embedded in day-to-day work. Clear RACI models—such as product data owners and sustainability controllers—create accountability and reduce back-and-forth.

Security and trust complete the puzzle. Sharing sensitive process and composition data across borders requires strong access controls and tamper evidence. Cloud platforms increasingly ship with immutable logs, policy-based access, and verified identities, which lets firms prove how, when, and by whom data was changed. Combined with supplier attestations and automated verification workflows, these features bring audit readiness into daily operations rather than year-end sprints.

The Rulebook And Compliance-By-Design

The DPP’s purpose is simple but demanding: create a standardized, verifiable product record that lives across the lifecycle. For early categories—batteries and metals—this means granular materials and substances data, carbon impacts, durability and repair scores, and guidance for end-of-life handling. As the scope extends to textiles, furniture, chemicals, ICT, and construction, category-specific attributes will layer onto a common core, reinforcing the need for flexible schemas and a consistent governance model.

Intersections with ESPR, CSRD, CSDDD, and the Battery Regulation matter because duplicative reporting is the enemy of speed. A compliance-by-design approach uses ERP to capture data once, validate it in governed workflows, and publish it to multiple audiences. Standards are the connective tissue: GS1 Digital Link for product identity and user access, EPCIS and CBV for event semantics, and ISO-aligned sustainability and LCA frameworks for methods and boundaries. Anticipated EU data-space guidelines will further harmonize exchange and consent patterns.

Compliance operations must be traceable. Audit trails, consent and access controls, supplier attestations, and verification steps need to be part of routine work. ERP enables this with master data management, workflow engines, immutable logs, and reporting pipelines. When extended via cloud interfaces, the same foundation connects to partners and regulators, reducing manual effort and cycle time while improving assurance.

Technology Trajectory And The Circular Advantage

Cloud ERP has emerged as the backbone for multi-stakeholder exchange and continuous compliance. Its value lies in orchestrating structured data, enforcing policy, and exposing standardized endpoints that partners can trust. Firms that lean into API-first ecosystems find it easier to onboard suppliers, update schemas, and reuse data for both regulatory and commercial needs.

AI maturity is rising as vendors embed services into core suites. Quality checks, fraud and risk signals, ESG coherence reviews, and automated classification of documents reduce human error and speed up approvals. Digital identifiers and product twins extend these gains into the field, enabling maintenance histories, repair instructions, and intelligent routing at end-of-life. The more product histories become machine-readable, the more circular flows become profitable.

Data spaces and industry consortia accelerate interoperability. Catena-X has shown how shared models and reference implementations shorten onboarding and align semantics, while Gaia-X principles inform trust frameworks. Economics reinforce the shift. Access to capital increasingly favors credible ESG performance, and tenders often reward traceability and low-carbon content. Early movers that systematize compliance reduce cost-to-comply, win trust, and unlock circular revenue streams.

Roadmaps point to stabilization of standards, automation of attestations, and broader category coverage. As APIs become the default, upgrades shift from painful projects to incremental versioning. Verification steps move from manual sampling to risk-based automation, and supplier onboarding becomes a measured flow rather than a crisis response. In that environment, compliance becomes continuous, and product data becomes an asset with multiple uses.

Actions And Outlook

This report pointed to a clear path forward. Midmarket firms that treated compliance as a design principle rather than a reporting afterthought had already begun to consolidate product data in cloud ERP, extend it through standard APIs, and govern it with named owners and service levels. Targeted pilots in batteries and metals produced reusable templates and playbooks for the next wave of categories, while AI-assisted checks reduced verification errors and sped up supplier onboarding.

Practical steps proved decisive. Mapping DPP fields to ERP objects, enriching materials attributes, and integrating lifecycle data through cloud connectors created the baseline. Establishing sustainability controllers and product data owners clarified accountability, and embedding role-based training into daily routines raised data hygiene. Measuring progress through leading indicators—data completeness, onboarding velocity, auditability, time-to-report, and cost-to-comply—kept teams focused and exposed bottlenecks early.

The broader market direction was already set. Compliance had become the main driver of digital transformation, cloud adoption had accelerated from hybrid stepping stones toward full platforms, and AI had shifted into embedded services. Firms that moved first spent less, complied faster, and built capabilities for circular business models that competed on trust and transparency as much as on price and delivery.