Freight keeps moving while the talent pipeline tightens, and that tension has forced European road carriers to confront whether the most powerful capacity lever sits not in metal or fuel but in the people behind the wheel who make every on-time delivery possible even as border rules, infrastructure gaps, and shifting expectations complicate every shift. The case for investing in drivers has gained weight as demand holds and structural shortages persist, pushing companies to prove that training, modern equipment, and humane schedules deliver safer operations and better service. One of the region’s largest asset-based haulers has made that bet explicit, arguing that driver-centric spending is not a discretionary perk. It is the backbone of resilience, a hedge against volatility, and a signal to customers that reliability is designed, not improvised.

Drivers as a strategic asset

Treating drivers as a strategic asset changes where budgets go and how success is measured, moving the focus from short-term cost control to long-term performance built on skills, safety, and pride in craft. Mindaugas Paulauskas has linked wellbeing and professional development directly to reliability and brand trust, arguing that cutting support for people pushes risk back into the network through avoidable incidents and inconsistent service. That framing invites a broader calculus: predictability in routes, respectful communication, and fair rotations are not soft benefits, but inputs that sharpen service quality. Moreover, it positions driver experience as a customer-facing differentiator, not just an HR concern.

The strategic lens also reframes the labor market itself. Europe’s driver pool is aging, and the profession’s image has dimmed among younger candidates who weigh time at home and safety alongside pay. Interest remains, evidenced by returning applicants and referrals, but friction at the point of entry and in daily conditions erodes conversion and retention. In this view, resilience hinges on rebuilding the appeal of the role: cleaner handovers, reliable information flows, and vehicles that reduce fatigue. When companies compete on these dimensions, they do more than staff trucks; they build a service culture that can absorb shocks without compromising safety or delivery windows.

Training and modern fleet as retention

A structured academy answers both a quality gap and a career gap. For a cross-border workforce arriving with varied training histories, standardized upskilling sets common expectations for load securing, temperature management, and advanced driver assistance systems. Girteka’s plan to invest about €300,000 in 2026 goes beyond compliance modules, aiming to deepen practical competencies that lower incident rates and cut claims. Continuous development also maps a progression path, making experience visible and portable inside the company. That matters for retention: people stay when growth is tangible, when expertise earns recognition, and when feedback loops lead to ergonomic tweaks or clearer routines.

Hardware investment magnifies those gains. A major order of 2,000 Volvo FH and FH Aero trucks, underpinned by a €173 million renewal program across 2025–2026, telegraphs a commitment to safety and comfort that drivers notice immediately. New trucks bring quieter cabins, better seats, and more effective ADAS, reducing cognitive load over long stretches and shrinking unplanned downtime. Those benefits echo down the chain: fewer breakdowns protect customer schedules; cleaner fuel profiles support sustainability goals; and modern telematics create a shared operational picture that supports coaching rather than punitive oversight. Technology and training, taken together, turn a hard job into a safer, smarter one.

Mobility rules and infrastructure realities

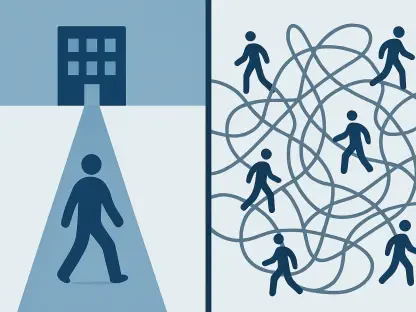

If talent is willing, the law still decides who gets to drive. The strongest near-term chokepoint sits in visas and work permits for non-EU professionals, where tightening regimes and uneven national practices stretch onboarding timelines or halt them outright. Carriers report ample applicant interest, including drivers seeking to return, yet face weeks of administrative lag that translate into idle trucks and unserved loads. That mismatch between market demand and legal throughput imposes a capacity ceiling that no recruitment campaign can overcome. It also distorts planning, as fleets hold positions open, shift assets, or decline lanes that hinge on cross-border coverage they cannot reliably staff.

Even for those on the road, the operating environment remains tougher than policy assumes. Field time from the “Mindaugas on the Road” initiative underscored how rules outpaced reality: the EU Mobility Package calls for weekly rest outside the cab, but secure parking and adequate lodging remain scarce on core corridors. Facilities are uneven, with some depots offering clean amenities and others lacking basic services. That gap undermines both compliance and morale, forcing drivers to trade safety for practicality. The result is predictable: stress rises, incidents risk increases, and the profession looks less attractive to new entrants. Fixing the daily journey is not a nicety; it is the fulcrum for retention and safety.

Shared responsibility and policy levers

Meaningful change will not come from carriers alone. Loading and unloading sites shape the driver experience as much as trucks do, and customers increasingly acknowledge that by weighing welfare standards in partner selection. Still, co-investment remains patchy. Consistent site playbooks, priority access protocols, and guaranteed facility standards would smooth dwell times and reduce frustration. Infrastructure operators have a parallel role in expanding secure parking with reliable sanitation, lighting, and connectivity. When every node honors basic expectations, training and technology can do their best work, and the job becomes a skilled profession rather than a daily grind against constraints beyond a driver’s control.

Policy can unlock capacity faster than any single company initiative. Clearer alignment on load-weight rules would cut delays from interpretation disputes, while stronger support for intermodal—targeted grants, streamlined terminals, synchronized schedules—would ease pressure on long-haul segments. Most consequential, easing legal pathways for vetted non-EU drivers would address shortages without eroding standards, provided training and oversight remain rigorous. Greater industry participation in rulemaking ensured that proposals landed as implementable steps, not idealized mandates. Taken together, these moves pointed toward a practical path: invest in people and tools, fix the choke points in law and infrastructure, and let professionalism drive the recovery.