In an era where tax professionals face mounting pressures to deliver accurate returns under tight deadlines, the introduction of cutting-edge tools can make all the difference in managing workloads effectively. Drake Software, a trusted name in tax preparation solutions, has unveiled a game-changing innovation with its Drake Workflow automation suite, launched in beta on September 16 of this year. This advanced feature set promises to redefine how tax preparers operate by streamlining processes, fostering seamless collaboration, and providing unprecedented visibility into client returns. As the tax season looms with its characteristic chaos, this development arrives as a beacon of hope for firms struggling with inefficiencies. Beyond just a new tool, it reflects a broader shift in the industry toward embracing technology to tackle persistent challenges. This article delves into the transformative potential of this suite, exploring its key features and situating it within the larger context of evolving trends in tax and accounting technology.

Revolutionizing Efficiency with Automation Tools

The core appeal of Drake Workflow lies in its ability to automate tedious, manual tasks that have long plagued tax professionals during peak seasons. By integrating seamlessly with existing Drake products such as Drake Tax, Drake Portals, and the newly launched Drake Tax Online, this suite ensures that data flows effortlessly across platforms, eliminating redundant steps. Features like automatic status updates remove the burden of tracking progress through outdated spreadsheets, while automated task routing directs assignments to the appropriate team members with flags for urgent items. A user-friendly dashboard offers an at-a-glance view of client return statuses, complemented by intuitive controls like drag-and-drop updates and easy delegation options. These advancements aim to slash the time spent on administrative duties, allowing preparers to focus on complex client needs. The result is a significant reduction in errors and a boost in productivity, addressing real pain points as highlighted by industry leaders at Drake Software who understand the chaos of tax deadlines.

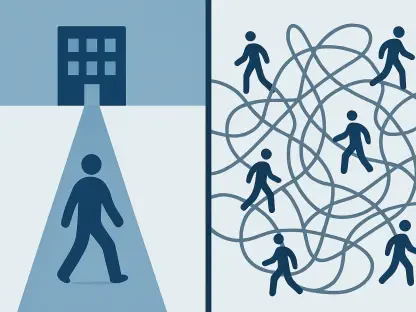

Another critical aspect of this automation suite is its emphasis on transparency and accountability within teams. Tax firms often grapple with miscommunication or delays due to unclear task ownership, especially when handling high volumes of returns. Drake Workflow counters this by providing real-time visibility into every stage of the preparation process, ensuring that everyone involved can track progress without constant check-ins. This fosters a collaborative environment where team members can quickly identify bottlenecks and address them before they escalate into major issues. Moreover, the system’s ability to flag urgent tasks ensures that critical deadlines are never missed, enhancing client satisfaction. By minimizing the guesswork and manual follow-ups, the suite not only saves time but also builds trust among staff and clients alike. This level of operational clarity is a transformative step for firms looking to modernize their workflows in a competitive landscape where efficiency can be a key differentiator.

Aligning with Industry-Wide Digital Transformation

Beyond the specifics of Drake Workflow, its launch aligns with a broader movement in the tax and accounting sectors toward digital transformation. Recent reports indicate a growing reliance on technology, particularly artificial intelligence and cloud-based solutions, to address operational inefficiencies. Surveys of tax practitioners reveal a stark performance gap between firms adopting AI-powered tools and those stuck with legacy systems, underscoring the urgency of modernization. Drake Workflow fits squarely into this trend by offering a cloud-compatible solution through Drake Tax Online, ensuring scalability and accessibility for firms of all sizes. This shift is not merely about keeping up with competitors but about meeting client expectations for faster, more accurate services. As economic uncertainty continues to challenge the industry, tools that enhance efficiency while reducing costs are becoming indispensable for staying relevant in a rapidly evolving market.

Cybersecurity, identified as a top concern for the fifth consecutive year in recent industry surveys, also plays a pivotal role in this digital shift. While automation and cloud solutions like Drake Workflow offer undeniable benefits, they must be balanced with robust security measures to protect sensitive client data. The increasing integration of technology in tax preparation brings new vulnerabilities that firms must address through strategic planning and investment in protective systems. Additionally, the rise of AI tools across professional domains, including employees turning to such platforms for guidance over traditional management, reflects a cultural shift that tax firms cannot ignore. Drake Workflow’s focus on integration and user-friendly design positions it as a tool that can adapt to these emerging dynamics, helping firms navigate the complexities of technology adoption while maintaining a secure and efficient operation.

Shaping the Future of Tax Preparation

Reflecting on the impact of Drake Workflow, it becomes evident that its beta launch marks a turning point for tax professionals seeking to overcome operational hurdles. The automation of routine tasks and the enhancement of team collaboration through real-time tracking stand out as pivotal changes that alleviate the stress of tax season. Industry trends, from the push toward AI to the persistent focus on cybersecurity, frame this tool as part of a larger narrative of technological adaptation that reshapes the field.

Looking ahead, the adoption of solutions like Drake Workflow signals a clear path for firms aiming to thrive in a digital landscape. Prioritizing scalable, secure systems while embracing automation emerges as essential steps for maintaining a competitive edge. As the industry continues to evolve, exploring how such tools can further integrate with emerging technologies offers a promising avenue for innovation. Tax professionals are encouraged to assess their workflows, identify areas for improvement, and leverage these advancements to build resilience against future challenges.