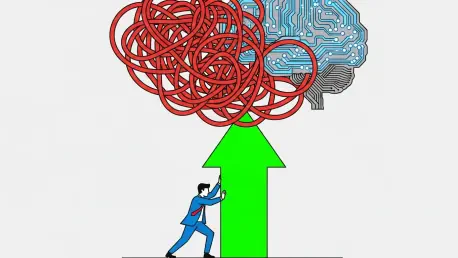

A stark dichotomy is defining the current global business landscape, where C-suite optimism for substantial revenue growth is running headlong into the formidable realities of pervasive cyber threats, fractured regulatory frameworks, and the complex, double-edged integration of artificial intelligence. Corporate leaders are exhibiting a bold strategic shift, moving beyond mere risk mitigation to actively leverage uncertainty for competitive advantage. However, this forward-looking ambition is being tested by systemic failures in critical compliance areas and the emergence of AI as both a revolutionary engine for innovation and a significant new source of enterprise risk. This tension between aggressive growth strategies and the challenging operational environment is forcing a fundamental re-evaluation of how organizations balance opportunity with responsibility in an era of unprecedented technological and regulatory change.

The Strategic Embrace of Risk Amidst Enduring Threats

Despite navigating a challenging global environment marked by economic volatility and rapid technological disruption, a significant majority of corporate leaders are expressing strong confidence in their future prospects. Recent survey data indicates that nearly 70% of C-suite executives and board members foresee major opportunities to expand revenues over the next two to three years. This bullish outlook is not a passive sentiment but reflects a deliberate strategic pivot from a defensive, risk-averse posture to one that actively seeks to harness risk for competitive gain. This proactive mindset is evident in their primary focus on transformation, innovation, and the cultivation of strategic alliances, with over 60% of leaders planning to expand their business ecosystems to enhance their go-to-market strategies. This strategic reorientation underscores a belief that in today’s market, the greatest risk may be inaction, compelling organizations to pursue ambitious growth initiatives even in the face of considerable uncertainty and an evolving threat matrix.

This confident pursuit of growth is, however, grounded in a sober assessment of the dangers that lie ahead. Cyber threats remain the paramount concern by a wide margin, a clear signal that issues like sophisticated ransomware, complex supply chain attacks, and major data breaches have moved from the IT department’s problem list to the top of the boardroom agenda. This focus is directly mirrored in corporate spending priorities, where cybersecurity investments are the leading focus for the coming years. Beyond digital threats, leaders are also increasingly concerned with operational and technological vulnerabilities. The challenges associated with outdated legacy IT systems and significant gaps in operational performance have grown in significance. Similarly, the difficulties in adopting emerging technologies and addressing the critical need for workforce upskilling have risen in prominence, highlighting a growing awareness that future success depends as much on internal capabilities and infrastructure as it does on market opportunities.

A Gauntlet of Regulatory Friction and Compliance Failures

While executives are charting courses for expansion, the regulatory and compliance landscape presents a significant and growing impediment. A stark analysis of Europe’s Anti-Money Laundering (AML) systems reveals a state of profound and persistent ineffectiveness, even as enforcement budgets continue to climb. The data paints a damning picture of systemic failure, with extremely poor conversion rates from suspicious activity reports (SARs) to meaningful law enforcement outcomes. The Financial Action Task Force has reported that the vast majority of assessed nations demonstrate low to moderate effectiveness in combating illicit finance. In Germany, for example, a mere 15% of SARs trigger an investigation, and 95% of those cases are ultimately closed without prosecution. This inefficiency is widespread, with estimates suggesting that a minuscule 2% of criminal proceeds are frozen and just 1% are ultimately confiscated within the EU, indicating a fundamental inability of the current framework to disrupt criminal financial networks effectively.

In an attempt to remedy these deep-seated issues, the European Union is advancing a significant AML reform package, which includes the establishment of a new EU-level anti-money laundering authority. However, this reform effort is intersecting with another major piece of legislation, the AI Act, which classifies critical AML tools like transaction monitoring and sanctions screening as “high-risk” applications of artificial intelligence. This designation imposes a battery of strict new compliance mandates, including requirements for enhanced transparency, robust human oversight, and comprehensive data governance. This adds a formidable layer of complexity for financial institutions that are looking to innovate with AI to move beyond the current ineffective, rules-based AML paradigm. This climate of regulatory uncertainty is also palpable in the United Kingdom’s legal sector, where a majority of professionals are concerned that proposed reforms to consolidate AML supervision under the Financial Conduct Authority could jeopardize the foundational principle of legal professional privilege.

The Pervasive Rise of a Double-Edged Technology

Artificial intelligence stands at the epicenter of many of the strategic opportunities and profound challenges identified across all sectors. Its adoption is surging, propelled by the promise of enhanced efficiency, significant cost reduction, and superior customer engagement. In the North American retail sector, for instance, research shows that AI is already active in most core functions at nearly half of all organizations, with generative AI implementation outpacing other forms. However, this rapid rollout has created a critical governance vacuum. The same research cautions that corporate leaders may be overestimating the tangible business impacts of these tools thus far, revealing that while adoption is high, AI policies remain dangerously underdeveloped. Only half of North American respondents feel their policies are comprehensive, and a majority of these frameworks fail to adequately address critical areas such as workforce impact, data transparency, intellectual property rights, and the mitigation of bias and unfairness.

This dual reality of AI as both a critical tool and a new frontier of risk is also evident in the investment community. A recent survey found that a majority of investors are already using AI or plan to within the next year, primarily to manage the growing volume and fragmentation of information needed for sustainable finance reporting. The technology is seen as essential for sustainability data collection and processing to meet escalating regulatory and client demands. Yet, this embrace is tempered by significant apprehension, with accuracy and the lack of transparency or explainability cited as the dominant concerns. This has led to a prevailing view that AI will serve to augment, rather than replace, human analysts. This cautious adoption connects directly to top-level executive fears, with nearly a third of leaders specifically highlighting the data integrity and cybersecurity exposures tied to AI. The technology is simultaneously a key priority for long-term growth and a powerful new vector for the most significant risks organizations face.

The Path Forward Demanded a New Synthesis of Strategy

The convergence of these powerful forces painted a complex and demanding picture for global business leaders. The drive for growth, exemplified by a proactive embrace of strategic risk, was undeniably a necessary response to a rapidly evolving market. However, this ambition was met with the harsh realities of a deeply flawed and increasingly complex regulatory environment, particularly in critical areas like financial crime prevention. Layered on top of this was the pervasive and disruptive influence of artificial intelligence, a technology that simultaneously offered the tools for future success while introducing novel and significant vulnerabilities. The ultimate challenge that emerged for the C-suite and the boardroom was not to address these issues in isolation, but to forge an integrated strategy that could navigate this fractured landscape. Success required a holistic approach that seamlessly wove together innovation, risk management, and compliance into the very fabric of the organization’s operating model, ensuring that the pursuit of opportunity did not come at the cost of resilience and integrity.