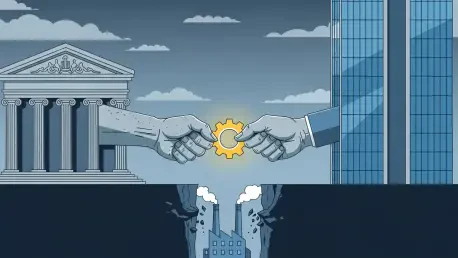

A dramatic and unforeseen clash between two major pieces of U.S. tax legislation is creating an immense financial crisis for America’s most innovative companies, threatening to stifle the very research and development that drives economic growth. The “One Big Beautiful Bill Act of 2025,” celebrated as a landmark victory for restoring critical R&D tax incentives, is being directly neutralized by a provision within the 2022 Inflation Reduction Act. This legislative collision, a stark example of unintended consequences in policymaking, has ensnared businesses in a complex tax trap where the relief they were promised is being systematically clawed back. The central conflict arises from a fundamental mismatch in how each law defines income, creating a scenario where a company’s tax liability can paradoxically skyrocket at the very moment it was meant to be reduced, jeopardizing billions of dollars in planned investments and the future of technological advancement.

The Shifting Sands of R&D Tax Policy

For many decades, the U.S. tax code actively promoted technological progress through a clear and powerful incentive embedded in Section 174 of the Internal Revenue Code. This provision permitted businesses to immediately deduct the full cost of their R&D expenditures in the year they were incurred. This policy of immediate expensing provided a direct and timely tax benefit, effectively lowering the cost of innovation and encouraging companies to invest heavily in creating new products and technologies. It created a predictable financial environment where the tax treatment of R&D aligned perfectly with its accounting treatment, ensuring that companies could reduce their taxable income in real time as they spent on research. This long-standing practice became a cornerstone of financial planning for R&D-intensive industries, from pharmaceuticals to software development, fostering a competitive edge for American businesses in the global marketplace and fueling generations of discovery.

This stable and innovation-friendly tax environment was abruptly upended in 2022 when a dormant provision from the 2017 Tax Cuts and Jobs Act (TCJA) took effect. This change eliminated the immediate deductibility of R&D costs, mandating a starkly different approach: domestic research expenses now had to be capitalized and amortized over five years, while foreign-sourced R&D faced an even more punitive 15-year amortization schedule. The financial repercussions were immediate and severe. Companies lost the ability to offset their income with current-year R&D spending, leading to significantly higher tax bills in the short term. This created a problematic asymmetry where book income for financial reporting reflected the full expense, but taxable income did not. This mismatch not only strained corporate cash flow but also stripped away the crucial time-value-of-money benefit associated with an immediate deduction, as future deductions are inherently less valuable due to inflation and uncertainty.

A Legislative Remedy Encounters a Hidden Trap

In response to the immense pressure from innovative industries, Congress acted to reverse the damaging effects of the TCJA’s amortization mandate. The “One Big Beautiful Bill Act of 2025,” signed into law on July 4, 2025, was designed to be a comprehensive remedy. It fully restored the policy of immediate expensing for domestic R&D, a move widely celebrated as a major victory for technology and manufacturing sectors. Critically, the legislation was made retroactive. This provision allowed companies to take a massive, one-time deduction in the 2025 tax year for all domestic R&D expenses they had been forced to capitalize and amortize from 2022 through 2024, in addition to deducting their full 2025 R&D costs. This was intended to make these companies whole, providing a substantial infusion of tax relief to correct for the previous three years of unfavorable tax treatment and to spur a new wave of investment in American innovation.

However, the intended benefits of this new law were immediately placed in jeopardy by a separate piece of legislation: the Corporate Alternative Minimum Tax (CAMT). A key provision of the 2022 Inflation Reduction Act, the CAMT was established to ensure that large, highly profitable corporations paid a floor level of tax. It imposes a 15% minimum tax, but its calculation is not based on the regular taxable income that is shaped by deductions and credits. Instead, the CAMT is levied on a corporation’s “adjusted financial statement income,” which is essentially the book income reported to shareholders and investors. The original intent was to prevent companies from using extensive tax loopholes to report huge profits to Wall Street while paying little to no federal income tax. Unfortunately, this well-intentioned provision was not designed to account for the unique, large-scale retroactive deduction created by the 2025 R&D law, setting the stage for an unprecedented fiscal conflict.

Analyzing the Financial Fallout

The core of the problem lies in the fact that the two laws operate on entirely different financial metrics. The massive R&D deduction from the 2025 Act works by significantly reducing a company’s regular taxable income, potentially lowering it to zero. However, for financial accounting purposes, R&D costs are typically expensed as they are incurred. Therefore, the special, multi-year tax deduction has no corresponding effect on a company’s book income. This creates a paradoxical situation: a company can fully utilize its new R&D deduction to eliminate its regular tax liability, only to find itself subject to a substantial tax bill under the CAMT. The minimum tax, calculated on the undiminished book income, effectively nullifies the tax savings that Congress explicitly intended to provide. This issue is particularly acute in 2025 because of the “stacking” effect of the retroactive provision, which concentrates four years’ worth of R&D deductions into a single tax year, creating an unusually large gap between book income and taxable income.

The real-world financial damage of this legislative collision is not merely theoretical; it is substantial and quantifiable. An in-depth analysis by the Bipartisan Policy Center estimated that a representative company in an innovative sector could see 32% of its anticipated tax savings from the new R&D deductions completely erased by the CAMT. For some of the nation’s largest technology firms, the consequences are even more dire. In a striking example, Meta is projected to face a staggering 87% effective tax rate for 2025. This extreme tax burden is a direct result of the CAMT preventing the company from realizing the financial benefits of its extensive R&D investments. Instead of being a powerful incentive for innovation, the restored deduction has become a trigger for an enormous and unintended tax liability, turning a legislative solution into a source of significant financial distress for the very companies it was meant to help.

A Potential Path to Resolution

With the clear legislative intent of the 2025 Act being subverted, a resolution was urgently sought. Industry interest groups, spearheaded by the R&D Coalition, began intense lobbying efforts directed at the Trump Administration, advocating for an administrative fix that would not require another act of Congress. The proposed solution centered on the U.S. Treasury’s existing regulatory authority to issue guidance that clarifies or adjusts how tax laws are implemented. Under this proposed workaround, the Treasury could permit companies to subtract their special R&D expense tax deductions from their book income before the CAMT liability was calculated. This adjustment would have effectively aligned the two conflicting tax systems, allowing the R&D deductions to reduce both regular and minimum tax obligations as lawmakers had intended. The Treasury reportedly considered issuing such guidance, which represented the most direct path to restoring the tax benefits for R&D-intensive companies and resolving the costly legislative stalemate that had cast a shadow over American innovation.