In the evolving financial landscape, the intersection of healthcare access and consumer finance takes center stage, with a key issue being whether medical debt should remain on credit reports. This debate is rooted in the broader quest for financial transparency versus consumer protection, as it could reshape the way creditworthiness is perceived and calculated. The outcome carries significant implications for both consumers and lenders, affecting the broader economic fabric with potential cascades into service accessibility and credit market efficiency.

Current Trajectory and Underlying Challenges

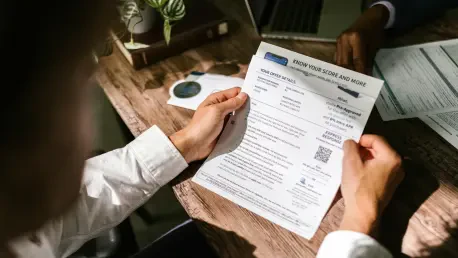

Medical debt accounts for a substantial portion of consumer obligations today, making its treatment a crucial topic in credit reporting narratives. The removal of such debts from credit records has sparked a wide-ranging discussion on its potential effects on market stability and consumer behavior. Proponents argue that medical debts often arise unexpectedly and should not hinder credit evaluations, while critics worry about the modulation of risk assessment processes. The trajectory of this debate could redefine consumer-lender dynamics, setting precedents for future credit policy adaptations.

Credit Reporting and Market Integrity

An essential consideration in this discussion is maintaining the integrity of credit reporting systems. Credit reports are foundational to assessing financial risk, influencing lender decisions on credit extension. The exclusion of medical debts from these evaluations might lead to distorted risk assessments, potentially elevating default risks across credit markets. Consequently, lenders may face challenges in accurately gauging consumer financial health, potentially impacting loan terms and availability and causing ripple effects on broader market conditions.

Healthcare Providers and Access to Services

A shift in reporting protocols also harbors implications for healthcare providers. With medical debts potentially absent from credit profiles, providers may adjust their credit service offerings, heightening scrutiny to gauge repayment reliability. This scenario could inadvertently limit healthcare accessibility for those lacking upfront financial resources. Conversely, amendments in credit practices might stimulate reformations in billing systems and encourage more comprehensive financial assistance, striving for a healthcare landscape that equitably reflects financial obligations without undue penalty.

Broader Economic Considerations

The complexities transcend individual consumers, extending into regional variations and technological innovations affecting debt management. Different jurisdictions may already have policies softening the credit impact of medical debts, revealing a patchwork of practices influencing broader economic perceptions. Emerging technologies in debt evaluation could contribute nuanced insights into financial health, distinguishing medical obligations from traditional debts. For policymakers and financial analysts, understanding these layered dynamics is crucial to navigating the shifting realities of credit reporting landscapes.

Strategic Insights and the Path Forward

Upon assessing these dynamics, the interplay between accurate credit reporting and essential service access emerges as a critical focal point. Policymakers must balance factual fiscal representation with humane consumer protection, ensuring that credit reports reflect an authentic picture of financial health while mitigating undue burdens from medical debt scenarios. As these considerations evolve, it becomes paramount for stakeholders at every level to actively engage with this discourse, fostering informed decisions that prioritize both market stability and equitable access.

Reflecting on Economic and Social Impacts

Looking backward reveals the significant influence these credit reporting adjustments have had on both markets and individual lives. The nuanced approach to integrating medical debts into credit assessments underscored the delicate balance between financial stability and consumer fairness, guiding ongoing dialogues. These discussions illuminated the intertwined nature of economic operations and social responsibility, offering deep insights for future policy refinements. As economic landscapes continue to change, these insights call for informed adaptability, highlighting the enduring relevance of these complex questions.