A significant number of individuals approaching retirement are navigating their financial futures with a sense of confidence that may not be grounded in reality, creating a precarious gap between their expectations and their actual preparedness. This disparity is often fueled by a deluge of online

The traditional battlegrounds of wealth management, once fought over exclusive products and competitive pricing, are rapidly being redrawn by the seismic force of enterprise technology. A new strategic imperative has emerged where industry leaders are no longer just acquiring tools but are

Situated on the shores of the Red Sea, Saudi Arabia's King Abdullah University of Science and Technology (KAUST) has quietly cultivated a deep-tech ecosystem that is now making significant noise on the global stage. Founded in 2009 as a postgraduate research institution, KAUST has reached a pivotal

The intense and escalating competition between Switzerland and Singapore for dominance in the Asian wealth management sector is far more than a simple rivalry; it is a critical dynamic that directly shapes the revenue streams, earnings quality, and stock valuations of the world's largest private

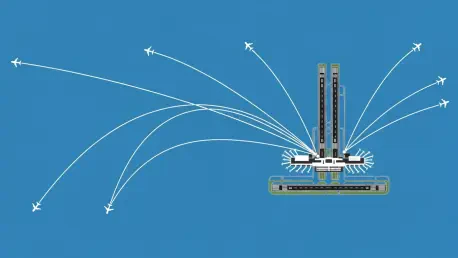

Malta International Airport has demonstrated an extraordinary period of growth, culminating in a landmark year that saw passenger traffic surpass all previous records and set a new benchmark for operational success. The airport's strategic initiatives, which focus on expanding its network,

In a global landscape marked by economic uncertainty, Saudi Arabia's consistent and robust growth has emerged as a significant outlier, a direct consequence of the nation's ambitious and meticulously executed Saudi Vision 2030 framework. This success is not the product of short-term policy

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41