I’m thrilled to sit down with Marco Gaietti, a renowned expert in business management with decades of experience in strategic management, operations, and customer relations. Today, we’re diving into the transformative work of the Circle Foundation, a new philanthropic initiative by Circle aimed at enhancing financial resilience and inclusion worldwide. Our conversation explores the Foundation’s focus on supporting small businesses in the US, its innovative global humanitarian efforts, and the unique ways it engages employees in social good. We’ll also touch on the long-term vision for systemic change in financial access and prosperity.

How did the Circle Foundation identify small businesses in the US as a critical focus for financial resilience, and what specific challenges are you aiming to tackle for them?

Thanks for having me, Richard. Small businesses are the backbone of the US economy, employing nearly half of private-sector workers and contributing over 40% to GDP, yet they often face steep hurdles in accessing affordable financing and modern digital tools. We saw this as a priority because these struggles can stifle growth, limit innovation, and even lead to closures, which ripple through communities. Many owners lack the resources to adopt technology that could streamline operations, or they’re turned away by traditional lenders due to perceived risk. Our initial step is partnering with Community Development Financial Institutions (CDFIs) to bridge these gaps with tech-focused, results-driven solutions. I remember visiting a small family-run bakery in the Midwest last year— they were barely scraping by because they couldn’t secure a loan for new equipment. That kind of story fuels our mission to ensure access isn’t just a buzzword but a tangible lifeline through targeted support and innovative tools.

Can you share the story behind the Foundation’s collaboration with the UN Refugee Agency in Ukraine, and what made using technology like USDC so impactful for displaced individuals?

Absolutely, that partnership is one we’re incredibly proud of. It started when we recognized the urgent need for fast, transparent aid delivery in Ukraine amidst the crisis, and connecting with the UN Refugee Agency felt like a natural alignment given their expertise on the ground. What made USDC—a digital currency—effective was its ability to bypass traditional banking delays and high transaction costs, ensuring aid reached people almost instantly. The process involved converting funds to USDC, transferring them securely via blockchain, and then enabling local partners to distribute resources directly to those in need. I recall hearing about a young mother who received support within hours of fleeing her home—she told our partners it was the first time she felt a flicker of hope, knowing help could arrive so quickly. That speed and trust are game-changers in humanitarian aid, and seeing those personal impacts reminds us why this tech matters so much.

The initiative in Venezuela, directing $18 million to healthcare workers during COVID-19, must have been a massive undertaking. What inspired that effort, and how did you ensure the funds made it to the right hands efficiently?

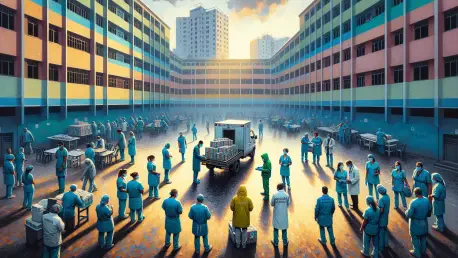

That project came from a deep sense of urgency during the peak of the pandemic when we learned healthcare workers in Venezuela were risking their lives without adequate support. We felt compelled to act because these frontline heroes were often unpaid or under-resourced, and $18 million became our commitment to change that. Ensuring the funds reached the right people meant meticulous coordination with local and international partners who knew the landscape—mapping out trusted distribution channels and leveraging digital tools for transparency. Behind the scenes, we held daily virtual huddles to troubleshoot logistics, from currency conversion to verifying recipients. I’ll never forget a message from a nurse who said the aid allowed her to buy protective gear and keep treating patients without fear of bringing the virus home. That feedback, alongside knowing we supported thousands, reinforced how precision and partnership can turn numbers into real human relief.

I’m intrigued by the policy of offering employees up to 40 hours of paid volunteer time annually for social good. How did this come about, and what’s the philosophy behind encouraging staff to get involved in community causes?

This policy emerged from a core belief that impact isn’t just about money—it’s about people giving their time and heart to causes they care about. We introduced the 40 hours of paid volunteer time because we wanted to empower our team to be active agents of change, not just employees. The philosophy is simple: when staff engage with nonprofits or community efforts, it builds empathy, strengthens our culture, and directly contributes to social good in ways dollars alone can’t. We support them by providing resources to explore causes that resonate personally, whether it’s environmental work or local education programs. One story that stands out is an employee who spent her hours mentoring at-risk youth—she came back saying she learned as much as she taught, especially from a teenager’s raw perspective on resilience. Those connections inspire us to keep fostering this kind of hands-on involvement.

Looking ahead, how does the Circle Foundation plan to turn individual programs into systemic change for financial inclusion on a global scale, and what does success look like to you in the coming years?

Our long-term vision is to move beyond isolated projects and create frameworks that reshape how financial access works worldwide, building on Circle’s tech foundation since 2013. We’re focused on scaling partnerships with global organizations to modernize humanitarian finance infrastructure, ensuring aid and resources flow faster and more transparently. One strategy I’m excited about is deepening tech integration in underserved regions—think blockchain-based systems for microloans or remittances that cut out predatory fees. Success in five years would mean seeing millions more people accessing financial tools, with measurable outcomes like a 20% increase in small business loan approvals in target areas or cutting aid delivery times in half. Picture a rural entrepreneur in Africa securing capital for her shop via a mobile app, or a disaster-hit community getting funds in days, not months. That’s the world we’re striving for, where technology doesn’t just enable transactions but rebuilds trust and opportunity at scale.

What’s your forecast for the future of financial inclusion, and how do you see technology continuing to drive this mission forward?

I’m optimistic but pragmatic about the future of financial inclusion. I believe we’re on the cusp of a revolution where technology like blockchain and digital currencies will dismantle barriers that have excluded billions from economic systems for too long. Over the next decade, I foresee a world where even the most remote communities can participate in global markets through accessible, low-cost tools—imagine farmers in developing nations getting fair prices via direct digital trades. But it won’t happen without tackling challenges like digital literacy and regulatory hurdles head-on. The key will be collaborative innovation, where tech companies, governments, and nonprofits align to prioritize people over profit. If we get this right, the sensory impact—seeing hope in someone’s eyes when they open their first digital wallet—will be the ultimate measure of progress.