In a cryptocurrency market characterized by volatility and a faltering price for its native XRP token, Ripple has embarked on a strategic expansion designed to reshape its role within the digital asset ecosystem. The company is decisively pushing into the multichain decentralized finance (DeFi) landscape, a move driven by two key assets: its newly introduced stablecoin, RLUSD, and an enhanced function for wrapped XRP (wXRP). This venture is not merely a reaction to market pressures but a forward-thinking initiative aimed at building a more interconnected, efficient, and compliant blockchain environment. By leveraging a dual-asset strategy, Ripple is positioning itself to address industry-wide challenges related to liquidity, interoperability, and regulatory trust. This deliberate pivot signals a profound evolution away from siloed blockchain operations toward a fluid, integrated network where digital assets serve a greater utility beyond simple speculation, potentially setting a new standard for cross-chain functionality and institutional adoption.

A Dual-Asset Strategy for a Seamless Multichain Future

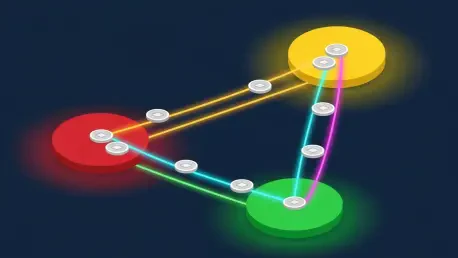

The introduction of RLUSD marks a significant step in Ripple’s multichain ambitions, positioning the stablecoin not just as another competitor in a crowded field but as a fundamental “transport mechanism” for value. Designed for superior speed, efficiency, and transparency, RLUSD is engineered to facilitate seamless transactions across diverse blockchain networks. The strategic roadmap includes a deliberate push into Ethereum’s layer-2 ecosystems, with networks like Optimism being prime targets for initial integration. This approach aims to leverage the scalability and lower transaction costs of layer-2 solutions while providing a stable, reliable asset for DeFi activities. By serving as a bridge between different chains, RLUSD is intended to reduce the friction and complexity often associated with cross-chain swaps and transfers. Its role is to become an indispensable tool for developers and users seeking a consistent and efficient medium of exchange within the burgeoning multichain world, enhancing liquidity and user experience on a wide array of decentralized exchanges and platforms.

Complementing the role of RLUSD, wrapped XRP (wXRP) serves as the second pillar of Ripple’s dual-asset strategy, designed to amplify cross-chain synergies and unlock new DeFi opportunities. While RLUSD provides stability, wXRP offers immediate liquidity and a direct pathway for XRP holders to participate in DeFi ecosystems beyond the XRP Ledger. Its integration into platforms on blockchains such as Solana demonstrates a clear intent to foster a more inclusive and interconnected financial landscape. This allows the vast liquidity of XRP to be utilized for lending, borrowing, and yield farming on other high-performance chains. The overarching goal is to break down the barriers that have traditionally isolated blockchain environments, creating a fluid network where assets can move freely and efficiently. This synergy between a stable transport asset and a liquid, versatile wrapped token is central to Ripple’s vision of a future where cross-chain trading is not a complex, multi-step process but a seamless and intuitive user experience.

Building Trust Through a Compliance-First Framework

Underpinning Ripple’s entire multichain initiative is a robust, compliance-first framework that serves as the cornerstone for building long-term trust and stability. This deliberate focus on regulatory adherence is crucial for attracting institutional investors who require a high degree of certainty and security before deploying capital into the digital asset space. By prioritizing compliance from the outset, Ripple aims to ensure the stability and authenticity of its digital assets, particularly RLUSD, which is backed by a portfolio of high-quality, liquid assets. This approach is designed to mitigate the risks that have plagued other stablecoins and to establish RLUSD as a reliable and transparent instrument for institutional-grade finance. Strategic partnerships, such as the collaboration with the regulated exchange Gemini, are pivotal in reinforcing this model, as they provide the necessary infrastructure and oversight to operate within established regulatory guidelines. This commitment is a critical factor in fostering widespread adoption in a market that remains cautious of regulatory uncertainty.

The effort to balance groundbreaking innovation with a solid, compliant infrastructure is further exemplified by the partnerships supporting its asset ecosystem. The backing of wXRP by Hex Trust, a licensed and insured digital asset custodian, is a key element in establishing a model that prioritizes security and regulatory alignment. Such collaborations are instrumental in providing the institutional-grade custody solutions that are essential for safeguarding assets and winning the confidence of large-scale market participants. This methodical approach demonstrates a clear understanding that for DeFi to achieve mainstream adoption, it must evolve beyond its speculative roots and offer the same level of security and regulatory clarity expected in traditional finance. By deliberately constructing a compliant foundation for its multichain ventures, Ripple is not only safeguarding its own ecosystem but also contributing to the maturation of the broader digital asset industry, paving the way for a more stable and institutionally-friendly future.

A New Precedent for Decentralized Finance

Ripple’s deliberate push into the multichain landscape with RLUSD and wXRP represented a potential transformation in the application and utility of digital assets. By focusing on a solid infrastructure that enhanced cross-chain trading capabilities, the company aimed to redefine liquidity dynamics and elevate the purpose of stablecoins far beyond simple speculation. The venture signaled a profound evolution toward an ecosystem where compliance and interoperability were paramount, fostering greater user adoption across a fragmented blockchain world. This strategic initiative was not merely about launching new products but about setting a new precedent for how digital currencies could function within decentralized finance. The dual-asset approach, combined with a steadfast commitment to regulatory alignment, created a powerful model for building a more resilient and interconnected financial future, one where institutional capital and everyday users could participate with greater confidence and efficiency.