After a volatile 2025, a $100 billion asset manager is calling for a major ‘re-risking’ into cryptocurrency. What do they see that others don’t? This question is at the heart of a developing trend in institutional finance. The public endorsement of digital assets as a core investment by a major player like VanEck signals a potential shift in mainstream financial strategy, moving crypto further from the fringes and closer to the center of sophisticated portfolio allocation. This move suggests that for some of the world’s largest investors, the calculus of risk and reward for digital assets is fundamentally changing.

This analysis will dissect the components of this emerging institutional confidence. It will explore the macroeconomic drivers fueling this new “risk-on” appetite, examine the evidence of growing adoption through VanEck’s Q1 2026 outlook, and weigh the potential opportunities against the significant contingencies that could challenge this bullish trend. The core issue is whether this is a temporary market reaction or the beginning of a more permanent integration of crypto into institutional investment frameworks.

The Macroeconomic Rationale for a Crypto Resurgence

A Favorable Climate: The Data Behind the ‘Risk-On’ Call

The foundation for this renewed interest in growth assets is built on a bedrock of stable economic indicators. With the S&P 500 trading at 6,966 and 10-year Treasury yields holding steady at 4.20%, the market landscape appears conducive to assets that thrive when uncertainty recedes. These figures are not just abstract numbers; they represent a collective investor sentiment that the most acute economic pressures have eased, allowing for a strategic shift away from defensive positions and toward assets with higher growth potential, such as cryptocurrency.

This stability is not accidental but is underpinned by clearer policy signals from Washington. Credible sources point toward a trend of shrinking U.S. deficits as a percentage of GDP, providing a degree of fiscal clarity that was absent in previous years. Moreover, monetary policy appears to have found a stable footing. This sentiment is reinforced by statements from officials like Fed Governor John Williams, who recently noted that current policy is “well positioned.” For institutional investors, this combination of fiscal predictability and stable monetary policy reduces tail risk and creates a compelling environment to “re-risk” their portfolios.

Case Study: VanEck’s Strategic Allocation

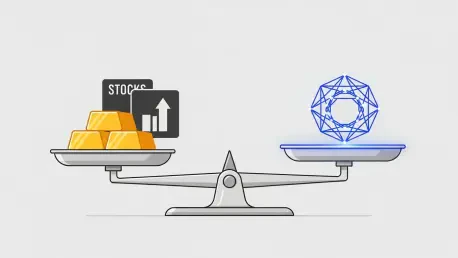

VanEck, a firm managing over $100 billion in assets, provides a concrete example of this trend in action. In its latest outlook, the firm is strategically grouping digital assets with other high-conviction sectors, including artificial intelligence, private credit, and gold. This is not a tentative exploration but a deliberate positioning of cryptocurrency as a legitimate component of a diversified, growth-oriented institutional portfolio. Such a move pushes the boundaries of traditional asset allocation.

By placing crypto alongside established and emerging growth sectors, VanEck is actively working to legitimize it as a core holding, moving it beyond the realm of pure speculation. The firm’s description of these assets as having “reset into more compelling opportunities” following the 2025 sell-off is particularly telling. It implies a view that the previous year’s volatility washed out market excesses, presenting current valuations as an attractive entry point for long-term strategic investment rather than short-term trading.

Insights from the Asset Management Frontline

The central thesis, as articulated by VanEck CEO Jan van Eck, identifies improved visibility in U.S. policy as the primary catalyst for this shift. According to this view, the recent period of clarity allows investors to look past short-term volatility and focus on fundamental growth drivers. This perspective from a seasoned industry leader underscores that the current trend is less about crypto-specific developments and more about a favorable top-down, macroeconomic environment that makes investors comfortable with taking on calculated risks again.

The significance of such a public endorsement cannot be overstated. In the world of institutional asset management, a firm like VanEck acts as a bellwether. Its public call to “re-risk” serves as a powerful signal that often precedes increased capital flows from other large investors and pension funds. This validation helps de-risk the asset class for other portfolio managers, making it easier for them to justify allocations to their own investment committees and clients, thereby potentially broadening the base of institutional adoption.

Future Outlook: Opportunities and Contingencies

This growing institutional acceptance, spearheaded by endorsements from established firms, could unlock a new wave of capital into the crypto market. As more asset managers follow suit, the increased liquidity and stability could foster a more mature market structure, further attracting conservative capital that has remained on the sidelines. The broader implication is a virtuous cycle where institutional adoption begets a more stable market, which in turn encourages further institutional investment.

However, the entire bullish thesis is contingent on the persistence of the very macroeconomic clarity that created it. This risk-on narrative is fragile and could be quickly undermined by unforeseen events. A surprise inflation report, a sudden geopolitical flare-up, or an unexpected pivot in Federal Reserve policy could instantly reverse capital flows as investors retreat to the safety of less volatile assets. The opportunity is real, but it exists within a delicate economic equilibrium.

Conclusion: A Conditional Bull Market

The analysis of VanEck’s Q1 2026 outlook provided a strong, data-backed case for renewed institutional investment in cryptocurrency. This argument was predicated on the emergence of stable U.S. fiscal and monetary policy, which together fostered an environment where investors felt confident enough to increase their exposure to higher-growth, higher-risk assets after a period of uncertainty.

This moment marked a critical step in the maturation of digital assets within the broader financial ecosystem. However, the future of this trend was not guaranteed. The durability of this institutional bull run was explicitly conditional on the very economic stability that created the opportunity in the first place, leaving the market in a state of cautious optimism.