In a detailed submission to the Board of Taxation's Red Tape Reduction Review, the Self-Managed Super Fund (SMSF) Association has identified significant and persistent compliance risks faced by small business owners and SMSF trustees, focusing on two primary areas of concern. The submission argues

As Nigeria's economy experiences a significant upswing, the nation's 39.6 million Micro, Small, and Medium-sized Enterprises (MSMEs), which contribute nearly half of the national GDP, are undergoing a fundamental transformation. These businesses, the veritable engine room of the economy and

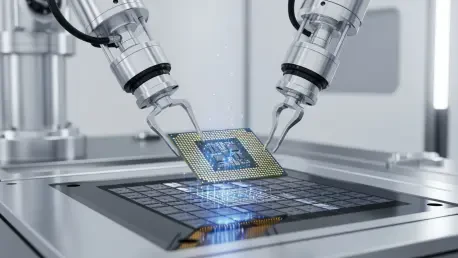

Amid the escalating rhetoric of a new technological cold war, the bipartisan consensus in Washington to curtail the sale of advanced semiconductors to China is widely viewed as a prudent measure to safeguard national security. This prevailing logic dictates that providing a strategic rival with the

A newly released analysis has delivered a stark ultimatum to the United Kingdom, asserting that the nation’s economic lifelines are dangerously frayed and demand an immediate and radical strategic overhaul to prevent a future of cascading crises. The report contends that decades of policy have

Navigating the financial markets often feels like steering a ship through a complex weather system, where traders must interpret conflicting signals from the wind and the barometer to plot a safe course. An asset’s price chart might be signaling clear skies ahead with strong upward momentum, yet

The global venture capital landscape of 2025 presented a profound contradiction, a market simultaneously reaching near-historic heights in investment activity while plumbing ten-year depths in its ability to raise new capital. This divergence was fueled almost entirely by a singular, powerful